FUNDAMENTAL INDUSTRY CHANGES

By Staff Reporters

***

***

Index Funds

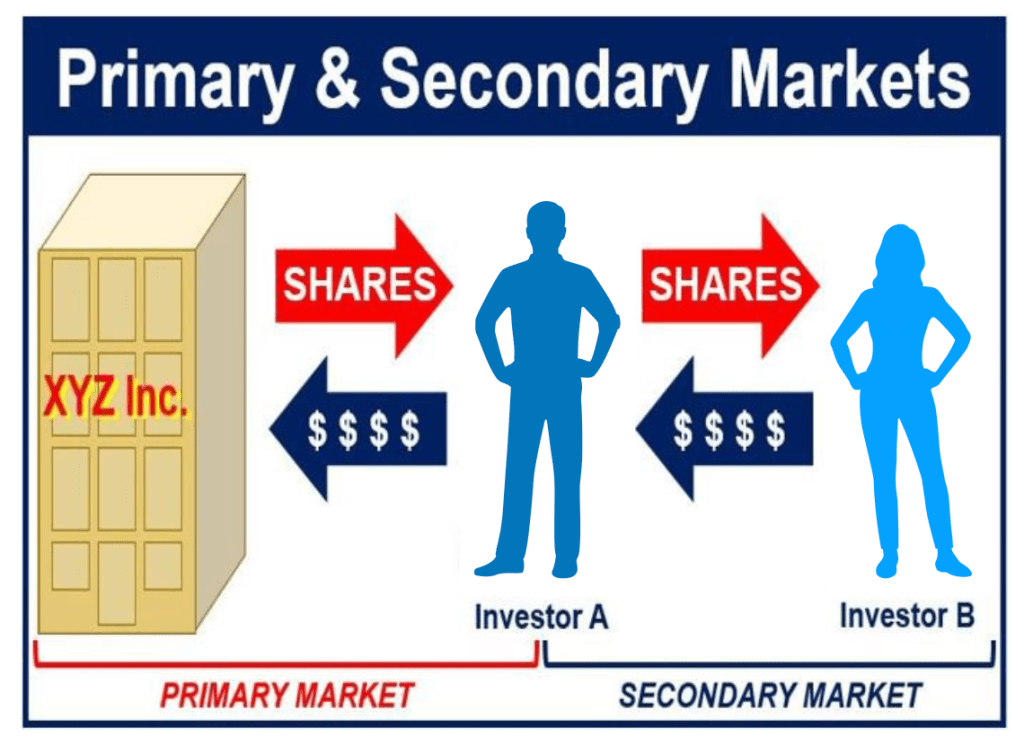

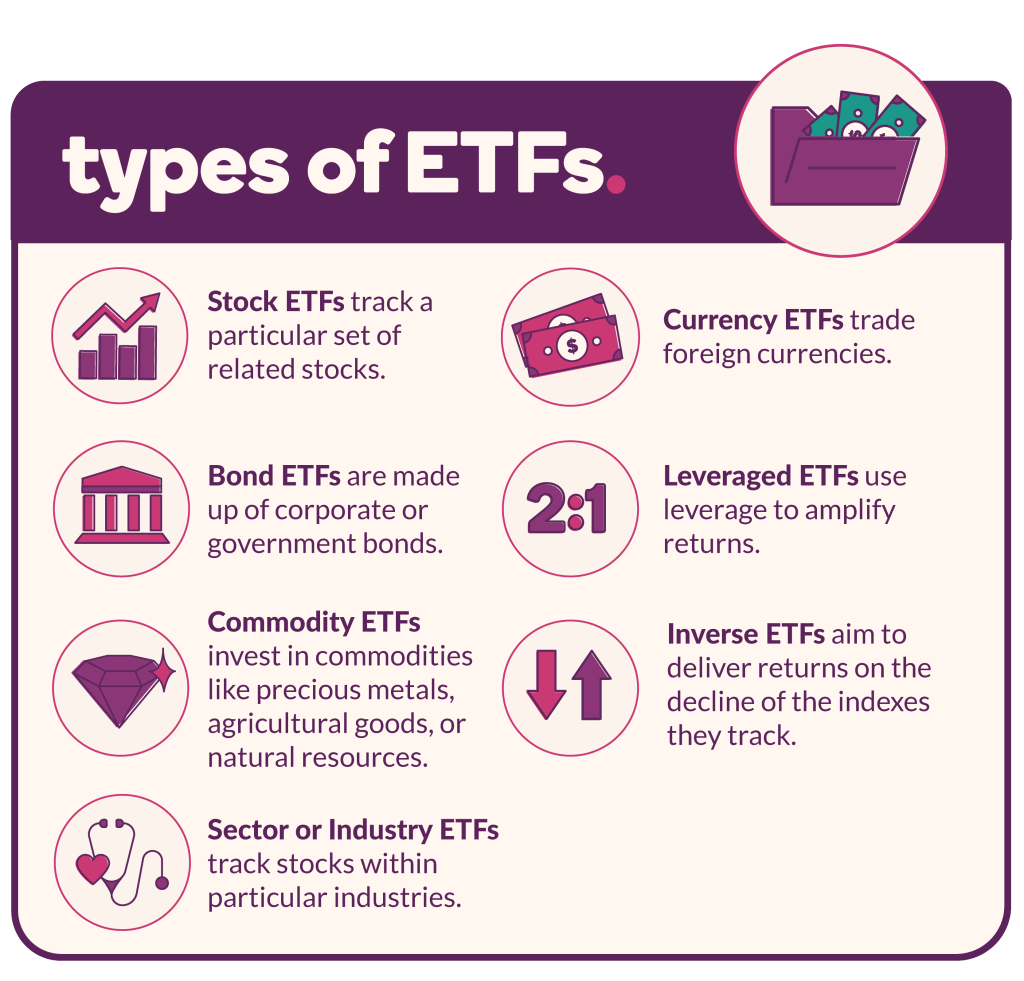

An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or “index,” like the popular S&P 500 Index—as closely as possible. That’s why you may hear people refer to indexing as a “passive” investment strategy.

Instead of hand-selecting which stocks or bonds the fund will hold, the fund’s manager buys all (or a representative sample) of the stocks or bonds in the index it tracks.

***

Quantum Computing

Unlike traditional computers that use bits, quantum computers utilize qubits. These qubits are capable of being in a state of superposition, where they can represent both 0 and 1 simultaneously, enabling the processing of multiple calculations at once. This could allow quantum computers to outperform classical computers in solving certain complex problems. However, the field is still overcoming challenges such as qubit stability and decoherence; especially in these three areas:

- Quantum computing could fundamentally alter healthcare by accelerating drug discovery and improving individualized medicine. Rapid analysis of enormous volumes of biological data allows quantum computers to find trends that might guide the creation of more potent treatments. In addition to accelerating drug development, this will enable customized treatments tailored to unique genetic profiles.

- Faster and more accurate financial models produced by quantum computing will transform the banking sector. Through real-time analysis of intricate financial systems, it can help investors to control risk and make better decisions. More precise market forecasts will help maximize portfolio management and trading strategies.

- Through greatly enhanced medical diagnosis and patient care, quantum computing can transform the healthcare industry. Quantum computers can remarkably accurately find trends and possible health hazards by analyzing enormous volumes of medical data in a fraction of the time. Early diagnosis and more customized treatment alternatives follow from this.

B–QTUM Index Fund

Index Description: The BlueStar® Machine Learning and Quantum Computing Index (BQTUM) tracks liquid companies in the global quantum computing and machine learning industries, including products and services related to quantum computing or machine learning, such as the development or use of quantum computers or computing chips, superconducting materials, applications built on quantum computers, embedded artificial intelligence chips, or software specializing in the perception, collection, visualization, or management of big data.

Citation and Disclosure: https://www.defianceetfs.com/qtum/

COMMENTS APPRECIATED

Read, Like, Subscribe and Refer

***

***

Filed under: Drugs and Pharma, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Information Technology, Investing | Tagged: banking, bits, BlueStar, BQTUM, bytes, Drugs, ETFs, exchange traded funds, finance, healthcare, HIT, Investing, IT, Machine Learning, Mutual Funds, personal-finance, Portfolio Management, QTUM, Quantum Computiog, qubits, stocks, Technology | Leave a comment »