Employee Retirement Income Security Act

By Staff Reporters

***

***

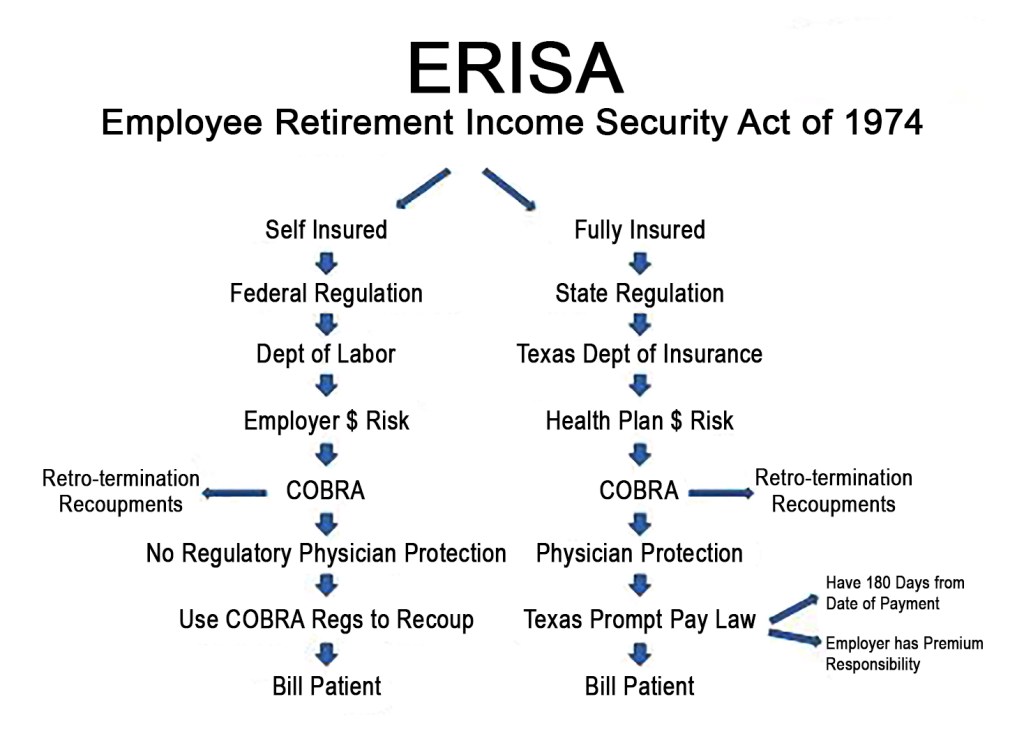

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

ERISA requires plans to provide participants with plan information including important information about plan features and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; and gives participants the right to sue for benefits and breaches of fiduciary duty.

***

There have been a number of amendments to ERISA, expanding the protections available to health benefit plan participants and beneficiaries. One important amendment, the Consolidated Omnibus Budget Reconciliation Act (COBRA), provides some workers and their families with the right to continue their health coverage for a limited time after certain events, such as the loss of a job. Another amendment to ERISA is the Health Insurance Portability and Accountability Act which provides important protections for working Americans and their families who might otherwise suffer discrimination in health coverage based on factors that relate to an individual’s health.

Other important amendments include the Newborns’ and Mothers’ Health Protection Act, the Mental Health Parity Act, the Women’s Health and Cancer Rights Act, the Affordable Care Act and the Mental Health Parity and Addiction Equity Act.

FIDUCIARY: https://medicalexecutivepost.com/2024/08/24/how-the-fiduciary-conundrum-defies-physics/

In general, ERISA does not cover group health plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment, or disability laws. ERISA also does not cover plans maintained outside the United States primarily for the benefit of nonresident aliens or unfunded excess benefit plans.

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Ethics, finance, Financial Planning, Funding Basics, Glossary Terms, Insurance Matters, Investing, Portfolio Management | Tagged: COBRA, Dept Labor, ERISA, Federal, fiduciary, health, healthcare, HIPAA, mental health, news, politics, State, The Employee Retirement Income Security Act of 1974 ( | Leave a comment »