DEFINITIONS

By Staff Reporters

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

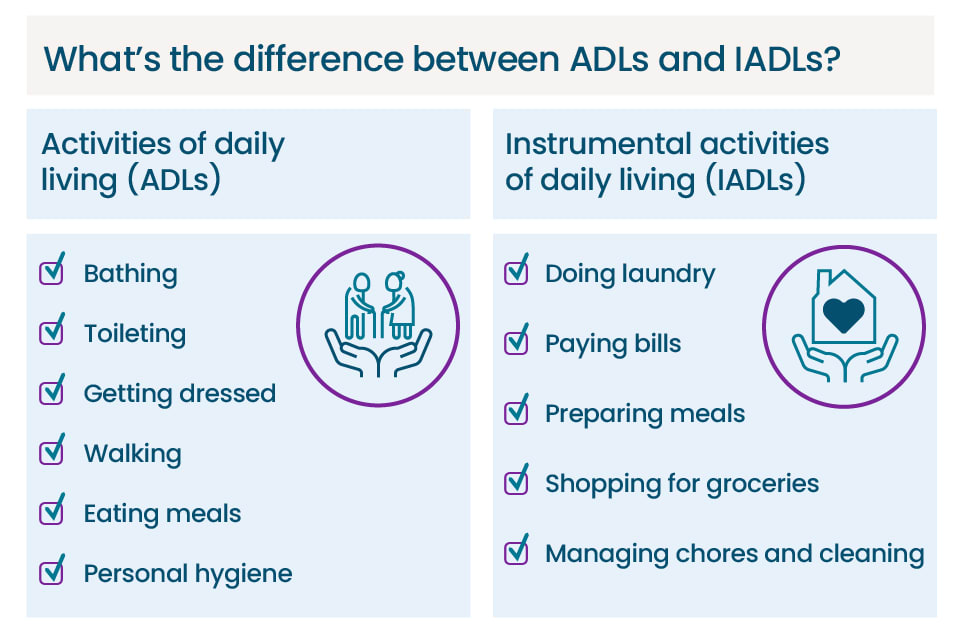

Activities of Daily Living (ADLs)

According to Leslie Kernisan MD MPH, these are the basic self-care tasks that we initially learn as very young children. They are sometimes referred to as “Basic Activities of Daily Living” (BADLs). They include:

- Walking, or otherwise getting around the home or outside. The technical term for this is “ambulating.”

- Feeding, as in being able to get food from a plate into one’s mouth.

- Dressing and grooming, as in selecting clothes, putting them on, and adequately managing one’s personal appearance.

- Toileting, which means getting to and from the toilet, using it appropriately, and cleaning oneself.

- Bathing, which means washing one’s face and body in the bath or shower.

- Transferring, which means being able to move from one body position to another. This includes being able to move from a bed to a chair, or into a wheelchair. This can also include the ability to stand up from a bed or chair in order to grasp a walker or other assistive device.

If a person is not fully independent with ADLs, then we usually include some information about the amount of assistance they require. ADLs were originally defined in the 1950s by a geriatrician named Sidney Katz, who was trying to define what it might look like for a person to recover to independence after a disabling event such as a stroke or hip fracture. So these measures are sometimes called the “Katz Index of Independence in Activities of Daily Living.”

***

***

Instrumental Activities of Daily Living (IADLs)

These are the self-care tasks we usually learn as teenagers. They require more complex thinking skills, including organizational skills. They include:

- Managing finances, such as paying bills and managing financial assets.

- Managing transportation, either via driving or by organizing other means of transport.

- Shopping and meal preparation. This covers everything required to get a meal on the table. It also covers shopping for clothing and other items required for daily life.

- Housecleaning and home maintenance. This means cleaning kitchens after eating, keeping one’s living space reasonably clean and tidy, and keeping up with home maintenance.

- Managing communication, such as the telephone and mail.

- Managing medications, which covers obtaining medications and taking them as directed.

Because managing IADLs requires a fair amount of cognitive skill, it’s common for IADLs to be affected when an older person is having difficulty with memory or thinking. For those older adults who develop Alzheimer’s disease or a related dementia, IADLs will usually be affected before ADLs are.

IADLs were defined about ten years after ADLs, by a psychologist named M.P. Lawton. Dr. Lawton felt there were more skills required to maintain independence than were listed on the original Katz ADL index, and hence created the “Lawton Instrumental Activities of Daily Living Scale.”

COMMENTS APPRECIATED

Like and Subscribe

***

***

Filed under: Ask a Doctor, Ethics, Experts Invited, Glossary Terms, LifeStyle, Marcinko Associates, mental health | Tagged: activities daily living, ADL, aging, Alzheimer's disease, anxiety, dementia, IADLs, Instrumental Activities of Daily Living, Leslie Kernisan MD, Marcinko, mental health, MP Lawton, Sidney Katz, what is ADLs?, what is IADLs?, who is MP Lawton?, who is Sidney Katz? | Leave a comment »