DEFINITIONS

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Seed money, also known as seed funding or seed capital, is a form of securities offering in which an investor puts capital in a startup company in exchange for an equity stake or convertible note stake in the company.

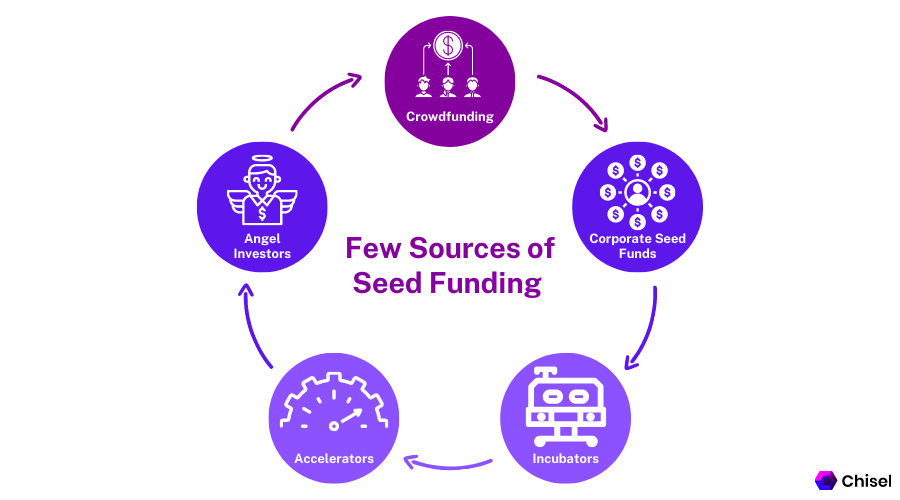

The term seed suggests that this is a very early investment, meant to support the business until it can generate cash of its own, or until it is ready for further investments. Seed money options include friends and family funding, seed venture capital funds, angel funding, and crowdfunding.

Types of Seed funding

- Friends and family funding: This type of seed funding involves raising money from friends and family members.

- Angel investing: As mentioned above, angel investors are wealthy individuals who provide seed funding in exchange for equity ownership.

- Seed accelerators: These are programs that provide startups with seed funding, mentorship, and resources to help them grow their businesses.

- Crowdfunding: This type of funding allows startups to raise money from a large number of people, typically through an online platform.

- Incubators: These are organizations that provide startups with seed funding, office space, and resources to help them grow their businesses.

- Government grants: Some government agencies provide seed funding for startups working on specific projects or in specific industries.

- Corporate ventures: Some big companies set up venture arms to provide seed funding to startups in their industry or complementary field.

- Micro-Venture Capital: A type of venture capital that provides seed funding to new startups and early-stage companies with a small amount of money.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Alternative Investments, Experts Invited, Funding Basics, Glossary Terms, Investing, Touring with Marcinko | Tagged: angel funding, angel investing, capital, corporate seed funds, crowd funding, crowd sourcing, funding, investors, Marcinko, micro-venture capital, seed capital, seed funds, seed money, Venture Capital | Leave a comment »