Trump orders creation of US sovereign wealth fund

BREAKING NEWS

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

What Is a Sovereign Wealth Fund (SWF)?

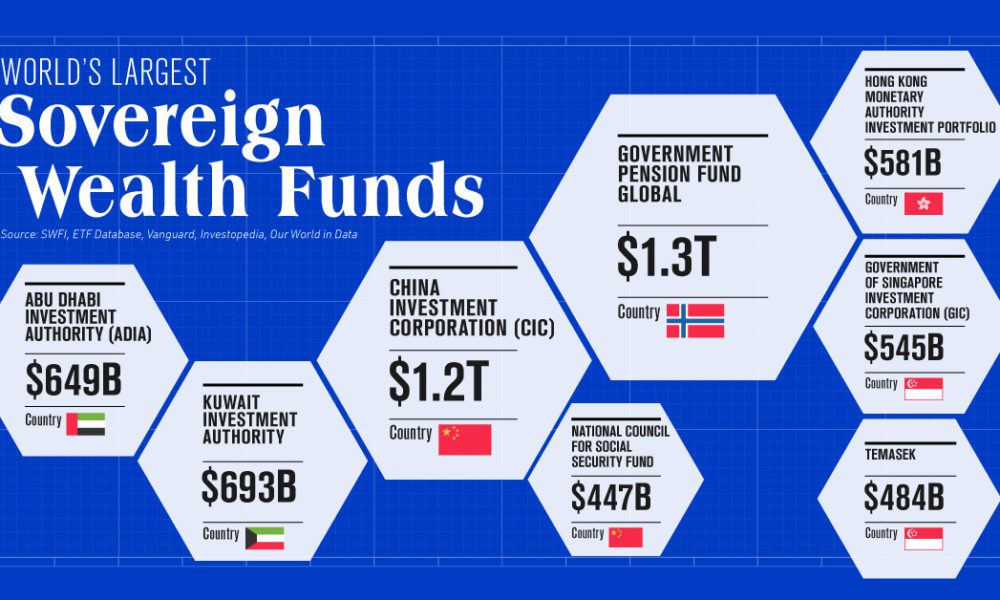

A Sovereign Wealth Fund (SWF) is a large pool of capital managed by a country’s government to achieve specific economic and social goals. These funds are invested in various assets such as stocks, bonds, real estate, commodities, and other financial instruments.

SWFs are typically funded from the savings of state-owned enterprises, foreign currency reserves from central banks, or commodity exports. The size and composition of each SWF can vary significantly between countries based on their respective economic circumstances. Each country has various reasons for setting up an SWF. However, the most common purpose of establishing one is to diversify and protect a country’s economy. For instance, this fund can be used as emergency reserves for potential future global financial shocks.

Purpose of a Sovereign Wealth Fund

Sovereign wealth funds invest a country’s wealth to achieve the government’s economic and social objectives. These funds provide countries with an additional method to diversify their economies and reduce risk exposure. They also give governments a chance to invest in global markets outside their own countries, which can get them better returns on their investments. This increases the earning potential on foreign exchanges and provides additional economic stability.

Furthermore, SWFs are a valuable tool to help countries build up buffers and savings for future generations to be better prepared for future economic shocks. Proper use of SWFs leads to long-term economic growth and stability.

In addition to providing an alternative form of investment for governments and enterprises worldwide, SWFs have also been used to increase financial transparency and accountability in many countries. By making their investment decisions public, these funds help promote corporate governance standards across the globe. This encourages market stability and reduces risks associated with certain types of investments.

MORE: https://www.financestrategists.com/financial-advisor/sovereign-wealth-fund-swf/

COMMENTS APPRECIATED

Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", Breaking News, Experts Invited, Funding Basics, Investing | Tagged: DJT, finance, finance strategists, Investing, money, personal-finance, sovereign wealth fund, SWF, SWFs, Trump, trump swf, Wealth | Leave a comment »