By Staff Reporters

***

***

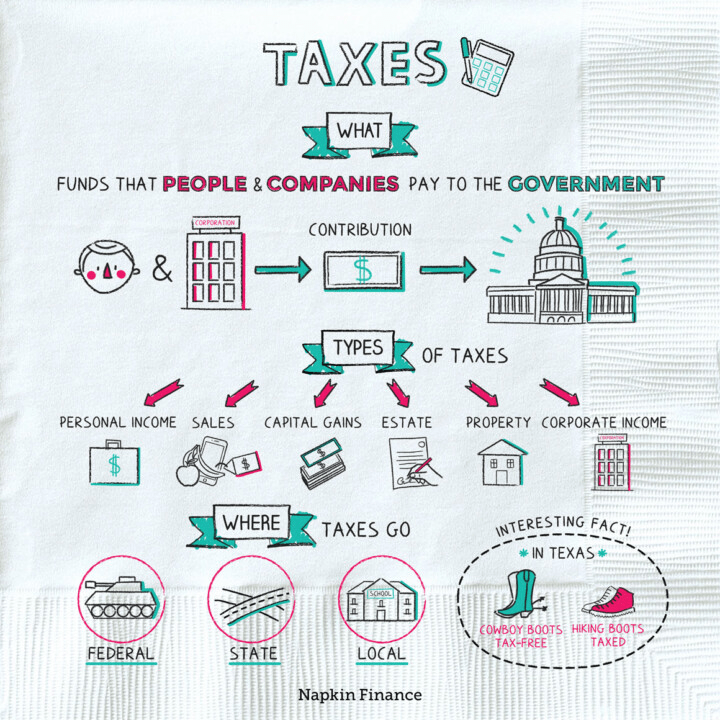

The IRS just released inflation-adjusted marginal rates and brackets for 2023 on Tuesday, and many workers will see higher take-home pay in the new year as less tax is withheld from their paychecks.

Additionally, the agency released the standard deduction for next year. It is increasing by $900 to $13,850 for single taxpayers, and by $1,800 for married couples, to $27,700. For heads of household, the 2023 standard deduction will be $20,800. That’s an increase of $1,400.

Here are the marginal rates for for tax year 2023, depending on your tax status.

Single filers

- 10%: income of $11,000 or less

- 12%: income between $11,000 to $44,725

- 22%: income between $44,725 to $95,375

- 24%: income between $95,375 to $182,100

- 32%: income between $182,100 to $231,250

- 35% income between $231,250 to $578,125

- 37%: income greater than $578,125

Married filing jointly

- 10%: income of $22,000 or less

- 12%: income between $22,000 to $89,450

- 22%: income between $89,450 to $190,750

- 24%: income between $190,750 to $364,200

- 32%: income between $364,200 to $462,500

- 35% income between $462,500 to $693,750

- 37%: income greater than $693,750

Additionally, the maximum Earned Income Tax Credit for 2023 is $7,430 for those who have three or more qualifying children. The maximum contribution to a healthcare flexible spending account is also increasing, from $2,850 to $3,050.

Wealthy Americans will also be able to exclude significantly more assets from the estate tax in 2023. Individuals will be able to transfer up to $12.92 million tax-free to their descendants, up from just over $12 million in 2022. A married couple can pass on double that. And the annual exclusion for gifts increases to $17,000.

***

COMMENTS APPRECIATED

Thank You

***

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Taxation | Tagged: IRS, New Taxation Rates and Brackets, tax, tax brackets, tax rates, taxes | 1 Comment »