Financial Services Sales Professionals

By: Dr. David E. Marcinko; MBA, CMP™

[Publisher-in-Chief]

It has been said that there are more than 95 financial services designations in the business; and most are suspect credentials. A college degree may not even be required for most of them.

It has been said that there are more than 95 financial services designations in the business; and most are suspect credentials. A college degree may not even be required for most of them.

And, the quest to find true guidance is clothed in mystery and subterfuge in the business.

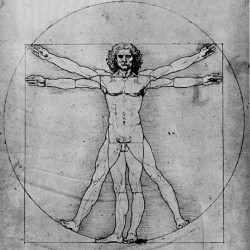

Why? It’s because the industry promotes a low standard of care, known as “suitability”; when a much higher fiduciary standard – to work on behalf of the client like a physician – should be required.

If you don’t believe me, just look in the classified ad section of your local newspaper under “sales positions”, for job listings for these folks.

So, when you select any type adviser, get this fiduciary standard-of-care statement in writing. Just think of the “golden rule”, as you ponder these traditional credentials.

What is an Insurance Agent?

No one, especially doctors, likes to pay life and disability insurance premiums. Inadequate coverage, however, can completely devastate your family or medical practice, by quickly wiping out a lifetime of asset accumulation and business equity.

Buying and maintaining the right amount and type of coverage from solid insurance companies at a reasonable price eliminates these risks in a very efficient manner. Unfortunately, an essential and relatively simple concept like risk transfer has evolved into an area that makes many doctors downright queasy.

The easiest way to handle this issue is to get consensus agreement from a core team of financial advisors as to the amount and types of coverage.

Once that is accomplished, appropriate insurance agents can be contacted. The agents should be captive agents with insurance companies with policies known to be good for the coverage in question. Otherwise, independent agents with access to a large number of companies and products can be contacted.

Regardless, in addition to the usual questioning regarding competence and a background check, the agent should be aware that the core team will review all proposals. Proposals should include what is known as a ledger statement.

A Chartered Life Underwriter (CLU) as granted by the American College, or Chartered Financial Consultant (ChFC), are two valid insurance designations demonstrating a focused expertise in the insurance business. But, these still are typically commission sales agents who work for their respective firms, or themselves, but not necessarily you. The saying goes “insurance is sold not bought.”

As a reformed insurance agent myself, I sold all sorts of personal and other business insurance, too.

Some years ago, the American Society of CLU and ChFC, in Bryn Mawr, Pa., reconsidered its own strategy of insurance as the organization changed its name to the Society of Financial Services Professionals to appeal to a broader base of financial practitioners beyond the insurance products it traditionally provided.

What is a Stock Broker [Registered Representative]?

A full service retail or discount stock broker, regardless of compensation schedule, is also known as a registered representative. Other names include financial advisor, financial consultant, financial planner, Vice President, etc. Nevertheless, they are still stock-brokers and not fiduciaries.

Typically, the national test known as a Series #7 (General Securities License) examination and state specific Series #63 license is needed, along with Securities Exchange Commission (SEC) registration through the National Association of Securities Dealers (NASD) to become a stockbroker. The industry touts them as rigorous; they are not as I passed mine after studying for a weekend. Since a commission may be involved – and performance based incentives are allowed – always be aware of costs.

Again, regardless, of nomenclature derivative, the goal of these folks is to sell financial products; and earn a commission or fee. You also typically sign away your right to litigate when you enter into a brokerage contract.

What is a Registered Investment Advisor?

This securities license, obtained after passing the easy Series # 65 examination, allows the designee to charge for giving unbiased securities advice on retirement plans and portfolio management, although not necessarily sell securities or insurance products.

An RIA, or RIA representative, is usually a fiduciary, and should work for the interest of the client. A registered-representative, financial consultant, Certified Financial Planner™, or stockbroker does not necessarily have to be.

What is a Certified Financial Planner™?

Some believe that the premier personal financial planning designation of choice for the Financial Planning Association (FPA) – originally located in Atlanta, then Denver and now Washington, DC and founded in 1969 – is board Certification in Financial Planning. This independent, designation represents a person who has completed a 24 month course of study at an accredited institution and passed the two day, comprehensive Certified Financial Planner Board of Standards Examination. This test encompasses all aspects of the financial planning process, including insurance, economic principles, taxation, investments and retirement benefits planning.

An ethics, continuing education and confidentiality requirement is also mandated for this designation [www.FPANet.org]. But, be warned however, a CFP is not necessarily a fiduciary and does not have to act on your behalf, or with your best interests in mind.

And, conflicts of interest do not necessarily have to be disclosed. There is much dissention in the industry regarding this situation, as I remain a former-reformed Certified Financial Planner™.

Still, the association’s marketing clout is powerful.

What is a Chartered Financial Analyst™?

A Chartered Financial Analysis™ will usually work for a brokerage house and follow one or a few publicly traded companies. CFA analysts may manage institutional money or run a mutual fund and have ethics requirements. This is a tough standard. I experienced it first-hand in business school.

Unfortunately, the previously unbiased nature of some Wall Street experts has been questioned lately with the collapse of such stocks as HealthSouth and others. Some authorities now feel that analysts have become merely promoters of the followed company, since sell recommendations are rarely made and CFAs or non-CFAs may cozy up to insiders and corporate executives as they curry their favor.

Contact the Association for Investment Management and Research (www.AIMR.org); now [www.CFAInstitute.org].

Q: Why is knowledge of the above important to physician-investors?

A: To avoid being ripped off!

Don’t believe me? Recall the tale of Dr. Debasis Kanjilal, a pediatrician from New York who put more than $500,000 into the dot.com company, InfoSpace, a few years ago, upon the advice of Merrill Lynch’s star analyst Henry Bloget. Is it any wonder that when the company crashed, the analyst was sued, and Merrill settled out of court? Other analysts, such as Mary Meeker of Morgan Stanley, Dean Witter and Jack Grubman from Salomon Smith Barney, are involved in similar fiascos. Remember; forewarned is forearmed.

8 Things your Financial Planner Won’t Tell You: http://articles.moneycentral.msn.com/RetirementandWills/CreateaPlan/8ThingsYourFinancialPlannerWontTellYou

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- PHYSICIANS: www.MedicalBusinessAdvisors.com

- PRACTICES: www.BusinessofMedicalPractice.com

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- BLOG: www.MedicalExecutivePost.com

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Financial Planning, Investing, Op-Editorials, Portfolio Management | Tagged: Financial Planning | 5 Comments »