Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Artificial intelligence has become one of the most transformative forces in modern finance. What began as a set of experimental tools for data analysis has evolved into a sophisticated ecosystem of algorithms that influence nearly every corner of global markets. From high‑frequency trading to risk management and fraud detection, AI now plays a central role in how financial institutions operate, compete, and innovate. Its rise has reshaped the speed, structure, and strategy of trading, while also raising new questions about transparency, fairness, and systemic stability.

At its core, AI excels at identifying patterns in vast amounts of data—patterns that are often too subtle or complex for human analysts to detect. Financial markets generate enormous streams of information every second: price movements, order flows, economic indicators, corporate disclosures, and even social sentiment. Traditional analytical methods struggle to keep pace with this volume and velocity. AI systems, particularly those built on machine learning, thrive in such environments. They can process millions of data points in real time, continuously refine their models, and adapt to changing market conditions. This ability to learn dynamically gives AI‑driven trading strategies a significant edge in speed and precision.

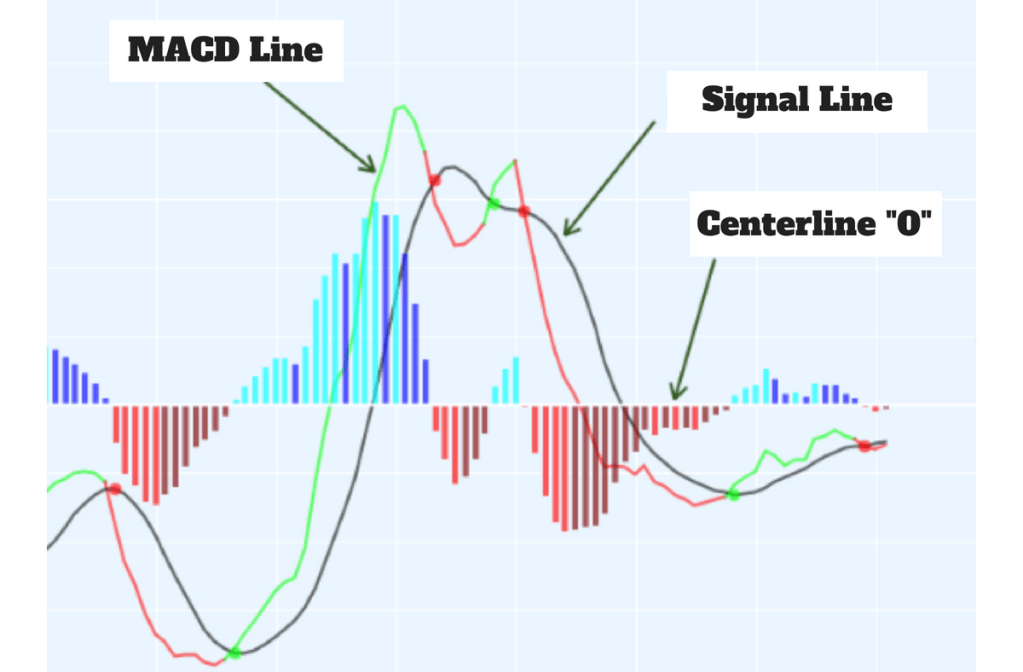

One of the most visible applications of AI in finance is algorithmic trading. Many trading firms now rely on automated systems that execute orders based on predefined rules or predictive models. High‑frequency trading (HFT) is a prominent example, where algorithms place and cancel orders within microseconds to exploit tiny price discrepancies. While HFT predates modern AI, machine learning has enhanced these strategies by enabling algorithms to anticipate short‑term market movements more effectively. AI‑powered systems can detect fleeting opportunities, adjust positions instantly, and manage risk with a level of responsiveness that human traders simply cannot match.

Beyond speed, AI has expanded the analytical toolkit available to traders. Natural language processing allows algorithms to interpret news articles, earnings reports, and even social media posts to gauge market sentiment. This capability has become especially valuable in an era where information spreads rapidly and investor reactions can shift within minutes. By quantifying sentiment and integrating it into trading models, AI helps firms anticipate volatility and position themselves accordingly. In many cases, these systems can react to breaking news before a human trader has even finished reading the headline.

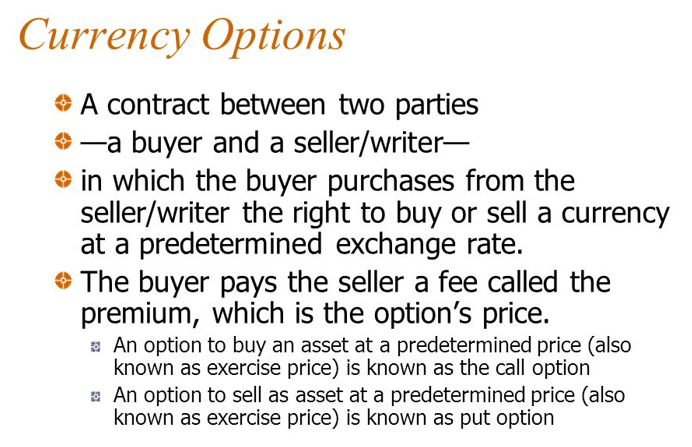

AI also plays a growing role in portfolio management. Robo‑advisors, for example, use algorithms to build and rebalance investment portfolios based on an individual’s goals, risk tolerance, and market conditions. While early robo‑advisors relied on relatively simple rules, newer systems incorporate machine learning to optimize asset allocation more dynamically. They can analyze historical performance, forecast potential outcomes, and adjust strategies as new data emerges. This has made investment management more accessible and cost‑effective for retail investors, while also pushing traditional firms to adopt more technologically advanced approaches.

Risk management is another area where AI has become indispensable. Financial institutions face a wide range of risks—market risk, credit risk, operational risk—and AI helps them monitor and mitigate these threats more effectively. Machine learning models can detect anomalies in trading behavior, identify early signs of credit deterioration, and simulate stress scenarios with greater accuracy. These tools allow firms to respond proactively rather than reactively, strengthening the resilience of their operations. In addition, AI‑driven fraud detection systems analyze transaction patterns to flag suspicious activity, helping protect both institutions and consumers.

***

***

Despite its many advantages, the integration of AI into financial markets is not without challenges. One major concern is transparency. Many AI models, especially deep learning systems, operate as “black boxes,” making it difficult to understand how they arrive at specific decisions. In a highly regulated industry like finance, this lack of interpretability can create compliance issues and complicate oversight. Regulators increasingly expect firms to explain the logic behind their models, which has sparked interest in developing more interpretable AI techniques.

Another challenge is the potential for AI to amplify systemic risk. Because many firms use similar data and modeling techniques, their algorithms may behave in correlated ways during periods of market stress. This can lead to rapid, self‑reinforcing price movements, as seen in several flash crashes over the past decade. While AI did not cause these events, the speed and automation it enables can exacerbate volatility if not carefully managed. Ensuring that AI systems incorporate safeguards—such as circuit breakers, diversity of models, and human oversight—is essential for maintaining market stability.

Ethical considerations also come into play. AI systems are only as good as the data they are trained on, and biased or incomplete data can lead to flawed outcomes. In areas like credit scoring or loan approvals, such biases can have real‑world consequences for individuals and communities. Financial institutions must therefore prioritize fairness, accountability, and transparency when deploying AI, ensuring that their models do not inadvertently reinforce existing inequalities.

Looking ahead, AI’s influence on financial markets is likely to grow even stronger. Advances in computing power, data availability, and model sophistication will enable even more accurate predictions and more efficient trading strategies. At the same time, the industry will need to balance innovation with responsibility. Human judgment will remain essential, not only to oversee AI systems but also to provide the strategic insight and ethical grounding that algorithms cannot replicate.

In sum, AI has become a powerful force reshaping financial markets and trading. It enhances speed, precision, and analytical depth, opening new possibilities for investors and institutions alike. Yet its rise also brings new complexities that require thoughtful governance and ongoing scrutiny. As AI continues to evolve, the financial sector will face the challenge—and the opportunity—of integrating these technologies in ways that promote efficiency, stability, and fairness.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Financial Planning, Funding Basics, Investing, Portfolio Management, Touring with Marcinko | Tagged: AI, artificial intelligence, business, david marcinko, finance, HFT, Investing, stocks, Technology, trading | Leave a comment »