MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2024 |

REFER A COLLEAGUE: MarcinkoAdvisors@msn.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

***

Low-income communities often struggle to access healthcare services, but a new analysis of federally qualified health centers (FQHCs)—which provide quality care to patients regardless of ability to pay—has helped nail down one reason. When it comes to screening for certain cancers, these nonprofit community health centers have fallen far behind the national average, according to a study led by cancer center researchers at the University of Texas MD Anderson and the University of New Mexico.

CITE: https://www.r2library.com/Resource

Healthcare bankruptcies surged in 2023, and it turns out many of the companies that went under had one thing in common: private equity (PE) ownership. At least 21% of the 80 healthcare companies that filed for bankruptcy last year were PE-owned, according to a report from the nonprofit Private Equity Stakeholder Project (PESP).

CITE: https://tinyurl.com/2h47urt5

Warren Buffett on contemplated his own mortality at Berkshire’s meeting. Succession was the topic du jour at the Berkshire Hathaway shareholder meeting in Omaha last week. After his longtime business partner Charlie Munger died last year at 99, CEO Warren Buffett—who turns 94 in August—revealed his heir apparent, Greg Abel, will have the final say on investment decisions in his absence. Buffett ended his Q&A portion with the quip, “I not only hope you come next year. I hope I come next year.” Adding to the ominous vibes, Buffett said AI is a genie that “scares the hell out of me.”

CITE: https://tinyurl.com/tj8smmes

Here’s where the major benchmarks ended:

- The S&P 500 index climbed 52.95 points (1.0%) to 5,180.74; the Dow Jones Industrial Average gained 176.59 points (0.5%) to 38,852.27; the NASDAQ Composite advanced 192.92 points (1.2%) to 16,349.25.

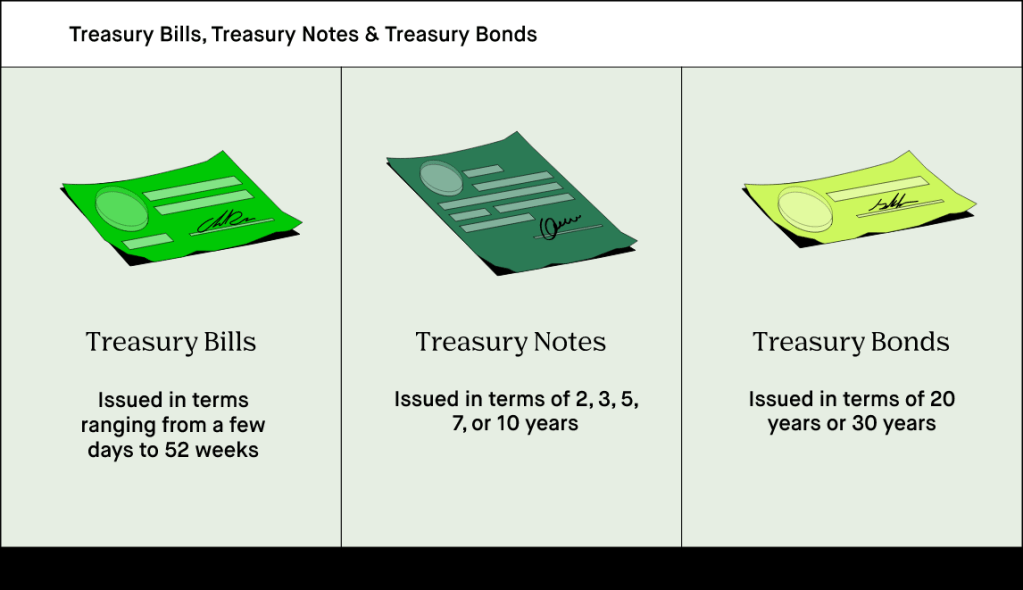

- The 10-year Treasury note yield (TNX) fell about 1 basis point to 4.491%.

- The CBOE Volatility Index® (VIX) was little changed at 13.48.

Semiconductors were among the strongest performers Monday behind Micron Technology (MU), whose shares rallied 4.7% after Robert W. Baird upgraded the chipmaker to “outperform” from “neutral.” Micron Technology was the top gainer in the Philadelphia Semiconductor Index (SOX), which advanced 2.2% to near a four-week high.

Small-cap stocks also got out of the gate strong this week. The Russell 2000® Index (RUT) gained 1.2% to end at a four-week high but is still up just 1.7% for the year, while the S&P 500 has gained 8.6%.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@msns.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Breaking News, Drugs and Pharma, Experts Invited, Financial Planning, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, iMBA, Inc., Information Technology, Investing, Managed Care, Marcinko Associates, Recommended Books, Sponsors | Tagged: Berkshire Hathaway, CBOE, Charlie Munger, DJIA, FQHCs, Greg Abel, healthcare bankruptcies, Marcinko, MD Anderson, NASDAQ, Private Equity, Private Equity Stakeholder Project, RUT, S&P 500, SOX, stocks gain, textbooks, TNX, VC, Venture Capital, VIX, Warren Buffett | Leave a comment »