By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

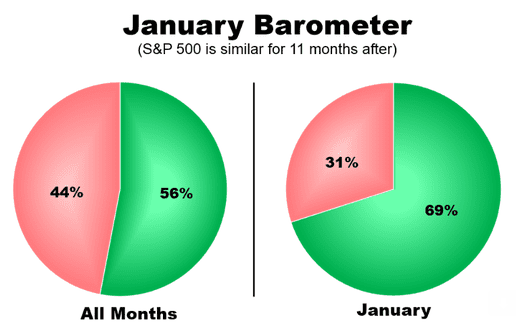

According to Rob Lenihan, of TheStreet, the January Barometer is a theory that says the investment performance of the S&P 500 in January is representative of the predicted performance of the entire year. The theory says that if stocks are higher in January, they should be higher for the year, and if they are lower in the first month, they’ll be lower for the year.

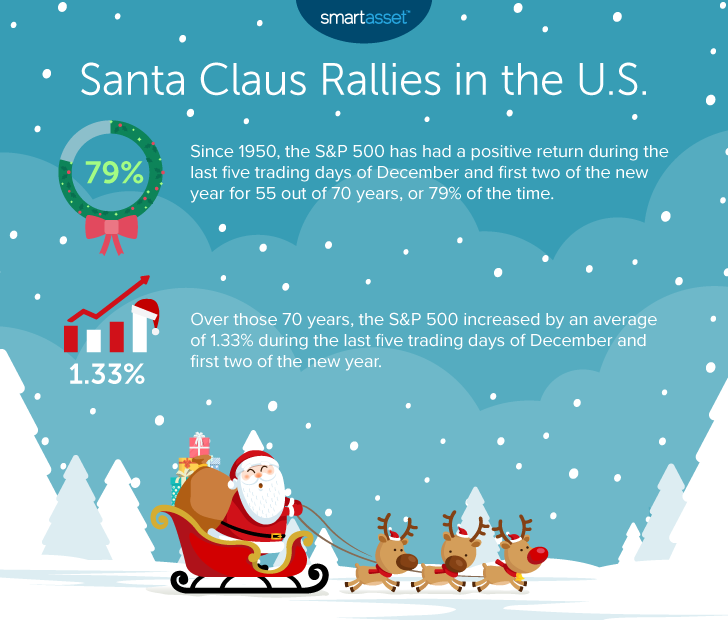

The S&P 500 finished down on January 31st, but the broad market ended up 2.6% for the month, so maybe we should heed the words of Wall Street legend Yale Hirsch, who first came up with the concept in 1972 in his Stock Trader’s Almanac, a widely read investment guide. Hirsch, by the way, also gave the world the Santa Claus Rally, which describes a rise in stock prices during the last five trading days in December and the first two trading days in the following January.

Analyst Stephen Guilfoyle said early this month in a post for TheStreet Pro that Santa Claus posted a loss this year, which was Santa’s second consecutive year in the red.

“No sweat,” the veteran trader said in his January 9th TheStreet Pro column. “That’s just a seasonal trade, and 2024 was a very nice year for U.S. equities in a broad sense.”

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Glossary Terms, Investing | Tagged: finance, Investing, investment performance, investments, January Barometer, personal-finance, S&P 500, santa claus rally, Stephen Guilfoyle, stock market, Stock Trader's Almanac, stocks, TheStreet Pro, US equities, Yale Hirsch | Leave a comment »