“Will you sign a fiduciary oath?”

PHYSICIAN COLLEAGUES AND MEDICAL PROFESSIONALS ASK

By Dr. David Edward Marcinko MBA CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

“SIGN IT -OR- FORGET IT”

Asking a “Financial Advisor” if they’re a fiduciary isn’t always enough to hire them. People can “ice skate” around that terminology and give fuzzy or unclear answers to that question. Instead, you may consider asking them to sign a fiduciary oath.

“If someone is fee-only, not “fee-based”, they shouldn’t have a problem signing a document stating how they get compensated.” “If someone is, for example, a broker dealer, insurance agent or investment advisor who works on commissions, they probably wouldn’t be allowed to sign it.” Just say NO to contract arbitration clauses, too! As well as “Dual Registration.” Remember Bernie Lawrence Madoff.

THE FIDUCIARY OATH

This one-page document outlines five fiduciary principles a financial adviser must follow to put the client’s interests ahead of their own. They include acting with prudence, not misleading the client, avoiding conflicts of interest, and disclosing and managing unavoidable conflicts.

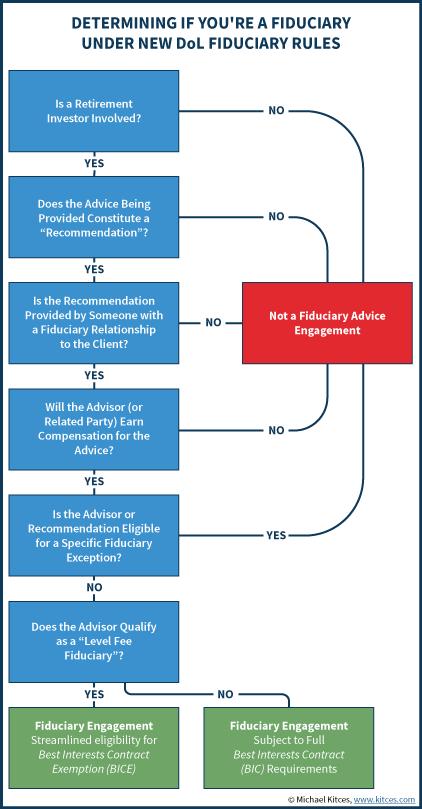

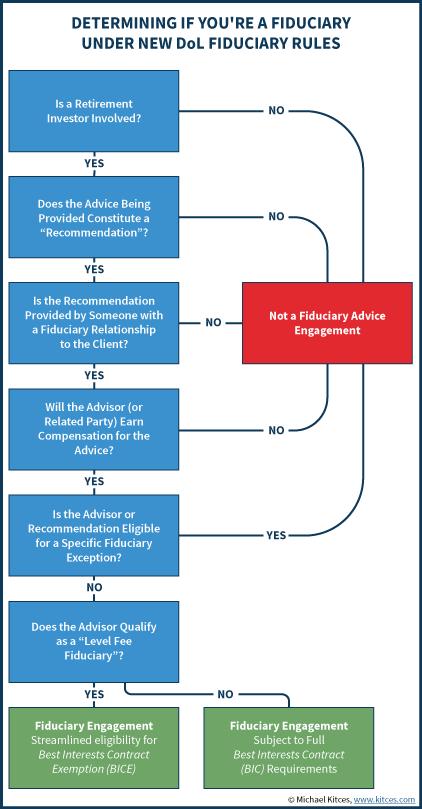

The oath, meant to be printed out and signed by an adviser, has been around for several years. But recent events, such as the 5th Circuit Court of Appeals striking down the DOL rule, have increased the urgency to get it into circulation.

“With the 5th Circuit ruling, it is just so important to have this oath out there because it states fiduciary principles,” said Ms. P. Houlihan, president of Houlihan Financial Resource Group. “The oath is the answer, given that the DOL rule is gone.”

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

Book Marcinko: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

Subscribe: MEDICAL EXECUTIVE POST for curated news, essays, opinions and analysis from the public health, economics, finance, marketing, IT, business and policy management ecosystem.

DOCTORS:

“Insurance & Risk Management Strategies for Doctors” https://tinyurl.com/ydx9kd93

“Fiduciary Financial Planning for Physicians” https://tinyurl.com/y7f5pnox

“Business of Medical Practice 2.0” https://tinyurl.com/yb3x6wr8

HOSPITALS:

“Financial Management Strategies for Hospitals” https://tinyurl.com/yagu567d

“Operational Strategies for Clinics and Hospitals” https://tinyurl.com/y9avbrq5

8

8

***

COMMENTS ARE APPRECIATED.

Thank You

***

Filed under: "Ask-an-Advisor", Career Development, CMP Program, Ethics, Financial Planning, Investing | Tagged: fee-based, fee-only, fiduciary oath, financial advisors, financial planners | 8 Comments »