By Dr. David Edward Marcinko MBA MEd and Copilot A.I.

SPONSOR: http://www.MarcinkoAssociates.com

***

***

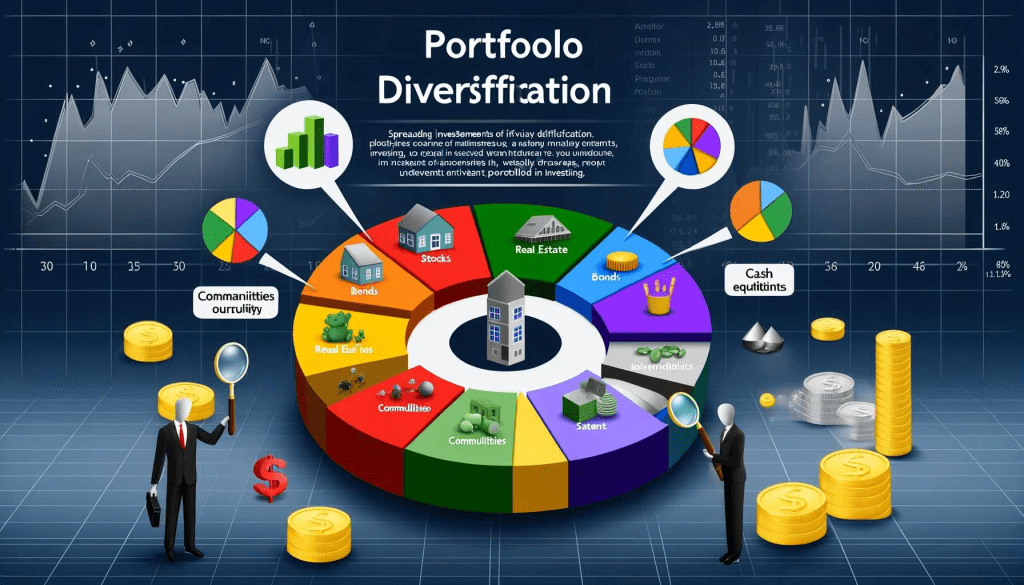

In the world of financial advising, few principles are as foundational—and as misunderstood—as diversification. Clients often come to advisors hoping for bold moves and big wins. Yet the most prudent strategy we offer is not a thrilling stock pick or a market-timing miracle, but a quiet, calculated spread of risk. Diversification, in essence, is the art of saying “sorry” in advance—for not chasing every hot trend, for not going all-in, and for not promising perfection. But it’s also the strategy that earns trust, builds resilience, and delivers long-term value.

Diversification means allocating assets across different sectors, geographies, and investment vehicles to reduce exposure to any single point of failure. For financial advisors, it’s not just a portfolio tactic—it’s a philosophy of humility. It acknowledges that markets are unpredictable, that no one can consistently forecast winners, and that protecting capital is just as important as growing it.

Clients may initially resist this approach. They might question why their portfolio includes lagging sectors or why we’re not doubling down on tech or crypto. This is where our role as educators becomes critical. We explain that diversification isn’t about avoiding risk—it’s about managing it. It’s the reason why, when tech stumbles, healthcare or consumer staples might hold steady. It’s why international exposure can buffer domestic volatility. And it’s why fixed income still matters, even in a rising-rate environment.

The challenge for advisors is that diversification rarely feels heroic. It doesn’t make headlines. It doesn’t deliver overnight gains. Instead, it delivers consistency. It smooths out the ride. It allows clients to sleep at night. And over time, it compounds into something powerful: confidence.

***

***

One of the most effective ways to communicate this is through behavioral coaching. We remind clients that diversification is designed to protect them from their own impulses—from chasing trends, reacting to headlines, or panicking during downturns. It’s a guardrail against emotional investing. And when markets inevitably wobble, diversified portfolios give us the credibility to say, “This is why we planned ahead.”

Moreover, diversification is a relationship tool. It shows clients that we’re not betting their future on a single idea. We’re building something durable. We’re thinking about their retirement, their children’s education, their legacy. And we’re doing it with a strategy that’s built to last.

In short, diversification may feel like an apology to the thrill-seeker in every investor. But it’s also a promise: that we’re here to protect, to guide, and to deliver results that matter—not just today, but for decades to come.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Financial Planning, Glossary Terms, Portfolio Management | Tagged: CFP, CMP, CPA, david marcinko, di-worsification, diversification, finance, financial advisor, financial planner, financial professional, Investing, investment advisor, personal-finance, stocks | Leave a comment »