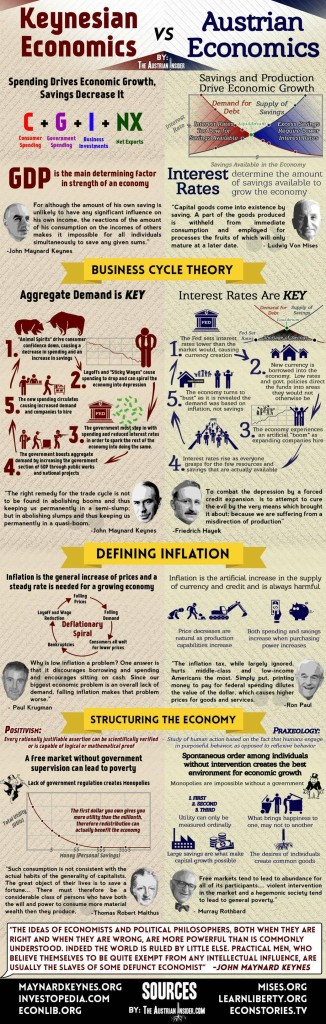

Austrian Economics vs. Keynesian Economics in One Simple Chart

Courtesy of

***

***

***

***

***

***

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements.

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

- HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

- CLINICS: http://www.crcpress.com/product/isbn/9781439879900

- ADVISORS: www.CertifiedMedicalPlanner.org

- FINANCE: Financial Planning for Physicians and Advisors

- INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

- Dictionary of Health Economics and Finance

- Dictionary of Health Information Technology and Security

- Dictionary of Health Insurance and Managed Care

***

Filed under: "Ask-an-Advisor", Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Health Economics | Tagged: Austrian Economics, economics, fed, Federal Reserve, FOMC, interest rates, Jeff Deist, Keynes, Keynesian Economics, Keynesian versus Austrian Economics | 1 Comment »