DR. DAVID EDWARD MARCINKO MBA MEd

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

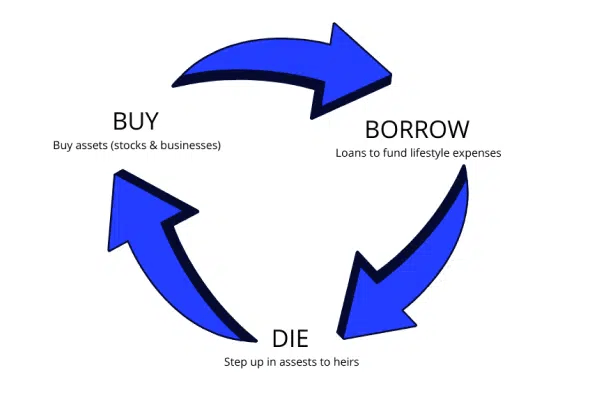

Here’s how the Buy, Borrow, Die strategy works step-by-step:

Step 1. Buy Assets

This step, broadly known as the accumulation phase, is about acquiring or creating valuable assets. It’s the most critical step taken by wealthy individuals to secure their wealth. Billionaires, for instance, often created startups that eventually turned into massive corporations. The asset here is the company they’ve established.

However, this isn’t the only way to accumulate assets. For professionals like doctors and lawyers, this phase involves securing a high-paying job and buying assets that have the potential to appreciate over time—like stocks, real estate, and private capital. Once an individual reaches a substantial level of wealth, they can leverage these assets in interesting ways using the next step of this strategy.

Step 2. Borrow Against Your Assets

This where the assets you’ve acquired are used as collateral to borrow money—all without triggering a taxable event.

Suppose you’ve got a robust stock portfolio. You can then take out a Securities Backed Line of Credit (SBLOC). This kind of loan lets you tap into the value of your portfolio without having to sell off any assets and subsequently paying capital gains taxes. What makes SBLOCs attractive to lenders is the relative ease with which the securities can be seized and sold, making them a low-risk lending option.

The ceiling for such a loan is usually around 50% of your portfolio’s value. However, we often caution against borrowing more than 25% of your account balance, especially for long-term loans. This will provide a cushion against stock market volatility, much like what we experienced in 2022 and 2023.

Borrowing against assets isn’t limited to stock portfolios either. Let’s say you own a home and have built up a certain amount of equity in it. You could opt for a Home Equity Line of Credit (HELOC), using your home as collateral. Banks tend to favor real estate-backed loans due to their stability compared to the fluctuating value of stocks.

Step 3. Die and Pass Your Wealth On

The final step in the strategy is where the proverbial tax baton is handed off to the next generation.

Under the existing tax code, when you pass away, your heirs receive a “stepped-up basis” on the assets they inherit from you. This means that their cost basis—the original amount paid for an asset—is stepped up to the market value of the asset at the time of your death. Meaning once you have passed away, your heirs would be able to sell the assets without having to pay taxes on the capital gain. Imagine you had purchased a building 20 years ago for $1 million and over the years, the value of that building increased to $2.5 million. If you were to pass away at this point, your heirs would inherit the building with the stepped-up cost basis of $2.5 million. This implies that if they decide to sell the property at this valuation, they wouldn’t owe any capital gains tax. This is because for tax purposes, their gain is calculated from the $2.5 million, not the original $1 million.

By utilizing this loophole, families can pass on their wealth without incurring a hefty tax bill. This is why many wealthy families set up trusts – it’s a way to manage and pass on their wealth at a stepped-up cost basis.

COMMENTS APPRECIATED

Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Experts Invited, Financial Advisor Listings, Financial Planning, Funding Basics, Glossary Terms, Investing, Sponsors, Taxation, Touring with Marcinko | Tagged: Accounting, BBD, bookkeeping, borrow, business, buy, buy borrow dies, CPA, die, finance, HELOC, home equity line credit, Investing, Marcinko, SBLOC, tax strategy | Leave a comment »