The 30th all-time high for the S&P 500 in 2014 alone

By Lon Jefferies MBA CFP®

Last week, the S&P 500 achieved an all-time high, exceeding the 2,000 level for the first time ever during intra-day trading. The index ended the day at 2,001 almost exactly triple the market low of 666 achieved in March of 2009 during the global financial crises. Yesterday, it reached another high; 2,007.

Last week, the S&P 500 achieved an all-time high, exceeding the 2,000 level for the first time ever during intra-day trading. The index ended the day at 2,001 almost exactly triple the market low of 666 achieved in March of 2009 during the global financial crises. Yesterday, it reached another high; 2,007.

Believe it or not, this was the 30th. all-time high for the S&P 500 in 2014 alone.

Fearing the Phrase

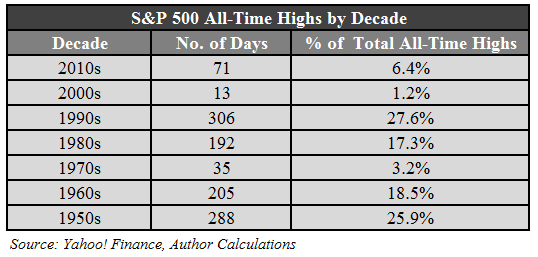

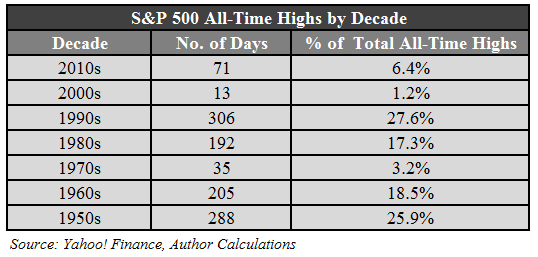

Many investors fear the phrase “all-time high,” believing it implies stocks have already captured the gains available in the market and that there is nowhere for the value of these equities to go but down. However, all-time highs are perfectly normal in the stock market. In fact, since 1950 there have been over 1,100 new all-time closing highs achieved by the S&P 500. That is 6.8% of all trading days or roughly 1 out of every 15 days the market is open that it’s closed at a new high level!

In addition, while it is true the S&P 500 hit a new nominal high, it is still significantly under its high when adjusted for inflation. In fact, Will Hausman, an economics professor at the College of William and Mary, calculates that the S&P 500 hit its true high – its inflation-adjusted high – of 2,120 on January 14, 1999. By that metric, 15 years ago the S&P 500 was 10% higher than it is now. Put that way, it is possible the market could continue to appreciate at its current pace without valuations exceeding their historical peak.

***

***

Market highs not necessarily bad

My goal is to point out that the phrase “all-time high” isn’t necessarily bad when relating to the stock market.

Now, just because stocks are at all-time high levels certainly doesn’t make them immune to a decline or even a crash. Stocks were at all-time high levels before the tech bubble of 2000 popped, and if by measured by the NASDAQ index, the market still hasn’t fully recovered. However, stocks aren’t required to decline just because they are at levels unattained before.

Assessment

Physicians and all investors don’t need to feel the need to sell their equity investments or not invest new dollars in the market just because the S&P 500 is at a number we haven’t yet seen. My favorite quote regarding the subject comes from financial columnist Nick Murray: “If you think the market is “too high,” wait until you see it 20 years from now.”

More:

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Investing | Tagged: Lon Jefferies MBA CFP®, Stock Market Highs | 12 Comments »