By Dr. David Edward Marcinko MBA MEd

SPONSOR. http://www.MarcinkoAssociates.com

***

***

The Role of Volatility Indices in Financial Markets

Volatility is often described as the pulse of financial markets, reflecting the collective emotions of investors as they respond to uncertainty, risk, and opportunity. Among the many tools designed to measure this phenomenon, the CBOE Volatility Index, or VIX, stands out as the most widely recognized. Dubbed the “fear gauge,” the VIX captures market expectations of near-term volatility in the S&P 500, derived from options pricing. Its movements often mirror investor sentiment: rising sharply during periods of crisis and falling when confidence returns. Yet, the VIX is not alone. A family of volatility indices exists across global markets, each offering unique insights into sector-specific or regional risk.

The importance of volatility indices lies in their ability to quantify uncertainty. Traditional measures such as historical volatility look backward, analyzing past price fluctuations. In contrast, indices like the VIX are forward-looking, reflecting implied volatility based on options markets. This distinction makes them invaluable for traders, portfolio managers, and policymakers. For example, a sudden spike in the VIX often signals heightened fear, prompting investors to hedge positions or reduce exposure to equities. Conversely, a low VIX suggests complacency, though it can also precede unexpected shocks.

Beyond the VIX, other indices provide complementary perspectives. The VXN tracks volatility in the Nasdaq-100, often dominated by technology stocks. Because the tech sector is highly sensitive to innovation cycles and regulatory changes, the VXN can diverge significantly from the VIX, highlighting sector-specific risks. Similarly, the RVX measures volatility in the Russell 2000, offering a window into small-cap stocks that are more vulnerable to domestic economic conditions. Internationally, indices such as the VSTOXX in Europe and India VIX extend this framework globally, allowing investors to compare risk sentiment across regions. Together, these indices form a mosaic of market psychology, enabling a more nuanced understanding of global financial stability.

Volatility indices also play a crucial role in risk management. Derivatives linked to these indices, such as futures and exchange-traded products, allow investors to hedge against sudden downturns. For instance, during the 2008 financial crisis, demand for VIX futures surged as investors sought protection from extreme market swings. More recently, volatility products have become popular among retail traders, though their complexity and tendency to lose value over time make them risky for long-term holding.

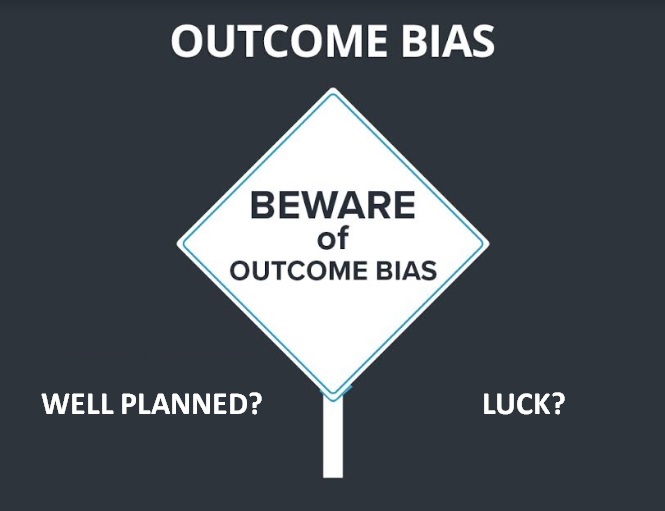

Critics argue that volatility indices can be misleading. A low VIX does not guarantee stability, and a high VIX does not always signal disaster. Moreover, the rise of volatility-linked products has occasionally amplified market stress, as seen during the “Volmageddon” event of February 2018, when inverse volatility ETFs collapsed. These episodes underscore the need for caution: volatility indices are powerful tools, but they must be used with a clear understanding of their limitations.

In conclusion, volatility indices such as the VIX serve as vital instruments for gauging investor sentiment and managing risk. They provide a forward-looking measure of uncertainty, complementing traditional metrics and offering insights across sectors and regions. While not infallible, their role in modern finance is undeniable.

For traders, analysts, and policymakers alike, these indices are more than numbers on a screen—they are reflections of the market’s collective psyche, guiding decisions in times of both calm and crisis.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Financial Planning, Funding Basics, Investing, Portfolio Management | Tagged: “Volmageddon”, CBOE, david marcinko, DJIA, ETFs, fear guage, finance, financial advisors, India VIX, Investing, investment advisors, NASDAQ, RVX, stock brokers, stock traders, stocks, VIX, Volatility Index, VSTOXX, VXN | Leave a comment »