By Staff Reporters

***

**

Inflation eased off historically high levels in July, raising hopes that a relentless surge in prices may have peaked. Consumer prices increased 8.5% from a year ago, down from a 9.1% annual rise – a 40-year high – in June, according to the Labor Department’s Consumer Price Index. Gasoline prices fell but food and rent continued to march higher. Economists surveyed by Bloomberg had estimated yearly inflation would fall to 8.7%. On a monthly basis, consumer prices were unchanged, compared to a 1.3% rise in June. Core prices, which exclude volatile food and energy items and generally provide a better gauge of future trends, increased 0.3% in July following a 0.7% rise the prior month. That held the annual increase at 5.9% after three straight monthly declines.

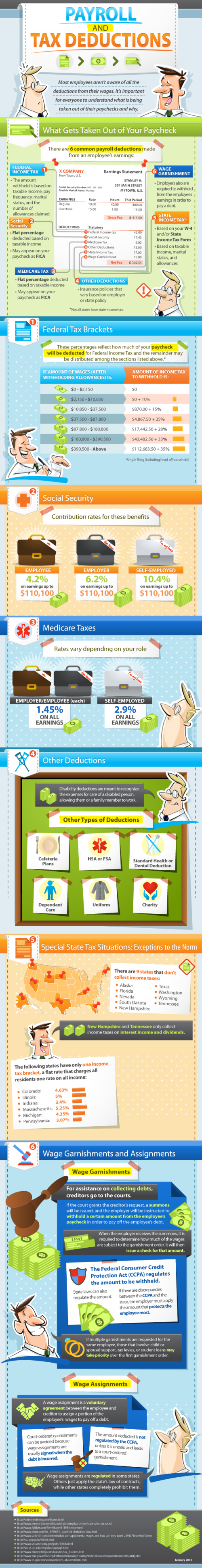

And, in a bit of good news for aged Americans, Social Security payments may take their biggest jump in years. The surge could be as high as 10%, which is larger than recent increases in the consumer price index. Social Security carries an official name of the “Old-Age, Survivors, and Disability Insurance (OASDI).” Even the rich can get benefits. The income calculation tops out at a maximum of $142,800.

***

COMMENTS APPRECIATED

Thank You

***

CITE: https://www.r2library.com/Resource/Title/082610254

FINANCIAL PLANNING: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

***

Filed under: "Ask-an-Advisor", Alerts Sign-Up, Insurance Matters, Investing, LifeStyle | Tagged: inflation, OASDI, Old-Age, social security, Survivors | Leave a comment »