By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Keynesian and Hayekian Approaches to Investing

The contrasting economic philosophies of John Maynard Keynes and Friedrich Hayek have shaped not only macroeconomic policy but also approaches to investing. While both thinkers sought to understand and improve economic systems, their views diverge sharply on the role of government, market behavior, and investor decision-making.

Keynesian economics emphasizes the importance of aggregate demand in driving economic growth. Keynes argued that markets are not always self-correcting and that government intervention is necessary during downturns to stimulate demand. In the context of investing, Keynesian theory supports counter-cyclical strategies. Investors following this approach might increase exposure to equities during recessions, anticipating that fiscal stimulus will boost corporate earnings and market performance. Keynes himself was a successful investor, known for his contrarian style and long-term focus. He advocated for active portfolio management, believing that markets are driven by psychological factors and herd behavior, which create mispricings that savvy investors can exploit.

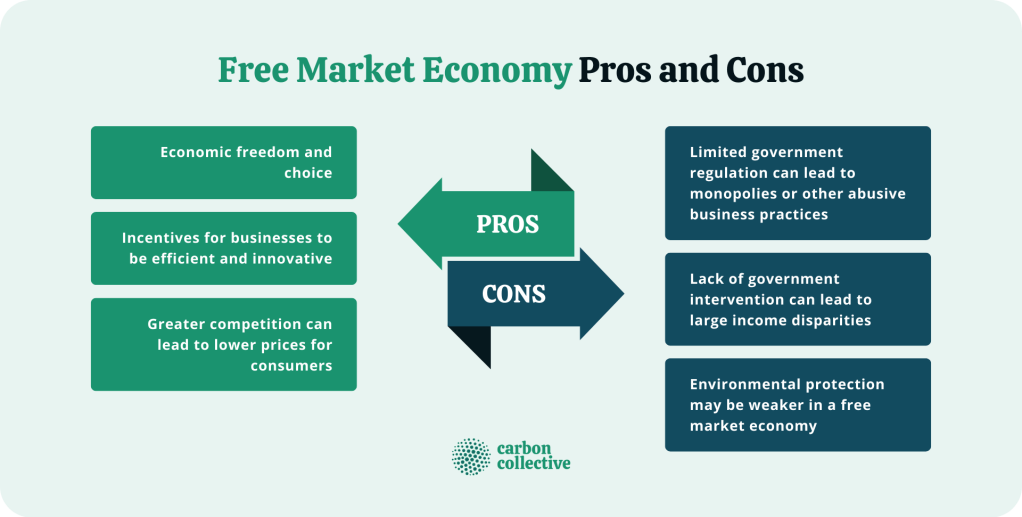

In contrast, Hayekian economics is rooted in classical liberalism and the belief in spontaneous order. Hayek argued that markets are efficient information processors and that decentralized decision-making leads to better outcomes than centralized planning. From an investment standpoint, Hayekian theory favors passive strategies and minimal interference. Investors aligned with Hayek’s philosophy might prefer index funds or diversified portfolios that reflect market signals rather than attempting to time the market or predict government actions. Hayek was skeptical of the ability of any individual or institution to possess enough knowledge to outsmart the market consistently.

The Keynesian approach tends to be more optimistic about the power of policy to influence markets. For example, during economic crises, Keynesians may expect stimulus packages to revive demand and thus invest in sectors likely to benefit from increased government spending. Hayekians, on the other hand, may view such interventions as distortions that lead to malinvestment and eventual corrections. They might invest more cautiously during periods of heavy government involvement, anticipating inflation, asset bubbles, or regulatory overreach.

Risk perception also differs between the two schools. Keynesians may see risk as cyclical and manageable through diversification and active management. Hayekians view risk as inherent and unpredictable, best mitigated through adherence to market fundamentals and long-term discipline.

In practice, modern investors often blend elements of both approaches. For instance, they may use Keynesian insights to anticipate short-term market movements while relying on Hayekian principles for long-term portfolio construction. The rise of behavioral finance has also added nuance, validating Keynes’s view of irrational market behavior while reinforcing Hayek’s skepticism of centralized forecasting.

Ultimately, the choice between Keynesian and Hayekian investing reflects deeper beliefs about how economies function and how much control investors—or governments—really have. Keynesians embrace adaptability and intervention, while Hayekians champion restraint and trust in the market’s invisible hand. Both offer valuable lessons, and understanding their differences can help investors navigate complex financial landscapes with greater clarity.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Advisors Only", "Ask-an-Advisor", business, CMP Program, economics, finance, Glossary Terms, Health Economics, Marcinko Associates, Portfolio Management | Tagged: A Hayekian Defense of Evidence-Based Medicine, Austrian Economics, economics, Hayek, Keynesian Economics, lifestyle, Marcinko | Leave a comment »