By Dr. David Edward Marcinko; MBA MEd

***

SPONSOR: http://www.MarcinkoAssociates.com

Common Economic Rules of Thumb

Here are some widely used heuristics in economics:

Growth & Investment

- Rule of 70: To estimate how long it takes for an economy to double in size, divide 70 by the annual growth rate. For example, at 2% growth, GDP doubles in 35 years.

- Okun’s Law: For every 1% drop in unemployment, GDP increases by roughly 2% — a rough link between labor and output.

- Taylor Rule: A guideline for setting interest rates based on inflation and economic output gaps. Central banks use it to balance inflation and growth.

Inflation & Employment

- Phillips Curve: Suggests an inverse relationship between inflation and unemployment — lower unemployment can lead to higher inflation, and vice versa.

- NAIRU (Non-Accelerating Inflation Rate of Unemployment): The unemployment rate at which inflation remains stable. Going below it may trigger rising prices.

Fiscal & Monetary Policy

- Balanced Budget Multiplier: Increasing government spending and taxes by the same amount can still boost GDP — because spending has a stronger immediate effect.

- Debt-to-GDP Ratio Threshold: Economists often flag a ratio above 90% as a potential risk to economic stability, though this is debated.

Trade & Exchange

- Purchasing Power Parity (PPP): Over time, exchange rates should adjust so that identical goods cost the same across countries — a rule used to compare living standards.

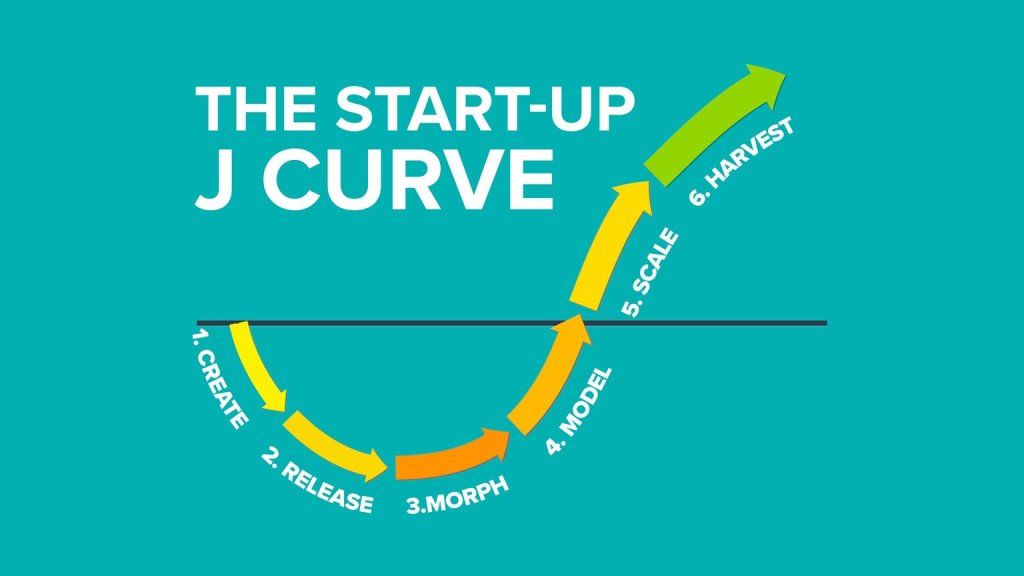

- J-Curve Effect: After a currency devaluation, trade deficits may worsen before improving due to delayed volume adjustments.

Trade

- Leading Indicators: Metrics like stock prices, manufacturing orders, and consumer confidence often signal future economic shifts.

- Recession Rule of Thumb: Two consecutive quarters of negative GDP growth typically indicate a recession — though not officially definitive.

These rules simplify complex relationships, but they’re not foolproof. They’re best used as starting points for analysis, not as rigid laws.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

Filed under: "Ask-an-Advisor", business, economics, finance, Investing, Marcinko Associates | Tagged: books, david marcinko, economic rules thumb, environment, financial rules thumb, GDP, google, J curve, NAIRU, observations, okun's law, Phillips Curve, PPP, random-thoughts, rules of thumb, taylor rule | Leave a comment »