By Dr. David Edward Marcinko; MBA MEd CMP™

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Investment Risk and Return

One of the major concepts that most investors should be aware of is the relationship between the risk and the return of a financial asset. It is common knowledge that there is a positive relationship between the risk and the expected return of a financial asset. In other words, when the risk of an asset increases, so does its expected return. What this means is that if an investor is taking on more risk, he/she is expected to be compensated for doing so with a higher return. Similarly, if the investor wants to boost the expected return of the investment, he/she needs to be prepared to take on more risk.

PORTFOLIO ALPHA: https://medicalexecutivepost.com/2025/07/02/managing-for-endowment-portfolio-alpha/

Harry Max Markowitz (August 24, 1927 – June 22, 2023) was an American economist who was a professor of finance at the Rady School of Management at UCSD. He is best known for his pioneering work in modern portfolio theory, studying the effects of asset risk, return, correlation and diversification on probable investment portfolio returns.

One important thing to understand about Modern Portfolio Theory (MPT) is Markowitz’s calculations treat volatility and risk as the same thing. In layman’s terms, Dr. Markowitz uses risk as a measurement of the likelihood that an investment will go up and down in value – and how often and by how much. The theory assumes that investors prefer to minimize risk. The theory assumes that given the choice of two portfolios with equal returns, investors will choose the one with the least risk. If investors take on additional risk, they will expect to be compensated with additional return.

MARKOWITZ: https://medicalexecutivepost.com/2011/01/19/the-living-legacy-of-dr-harry-markowitz/

According to MPT, risk comes in two major categories:

- Systematic risk – the possibility that the entire market and economy will show losses negatively affecting nearly every investment; also called market risk

- Unsystematic risk – the possibility that an investment or a category of investments will decline in value without having a major impact upon the entire market.

***

***

Diversification generally does not protect against systematic risk because a drop in the entire market and economy typically affects all investments. However, diversification is designed to decrease unsystematic risk. Since unsystematic risk is the possibility that one single thing will decline in value, having a portfolio invested in a variety of stocks, a variety of asset classes and a variety of sectors will lower the risk of losing much money when one investment type declines in value. Thus putting together assets with low correlations can reduce unsystematic risks.

DIVERSIFICATION: https://medicalexecutivepost.com/2024/08/13/the-negative-short-term-implications-of-diversification/

a. Understanding the Risk

Although broad risks can be quickly summarized as “the failure to achieve spending and inflation-adjusted growth goals,” individual assets may face any number of other subsidiary risks:

- Call risk – The risk, faced by a holder of a callable bond that a bond issuer will take advantage of the callable bond feature and redeem the issue prior to maturity. This means the bondholder will receive payment on the value of the bond and, in most cases, will be reinvesting in a less favorable environment (one with a lower interest rate)

- Capital risk – The risk an investor faces that he or she may lose all or part of the principal amount invested.

- Commodity risk – The threat that a change in the price of a production input will adversely impact a producer who uses that input.

- Company risk – The risk that certain factors affecting a specific company may cause its stock to change in price in a different way from stocks as a whole.

- Concentration risk – Probability of loss arising from heavily lopsided exposure to a particular group of counterparties

- Counterparty risk – The risk that the other party to an agreement will default.

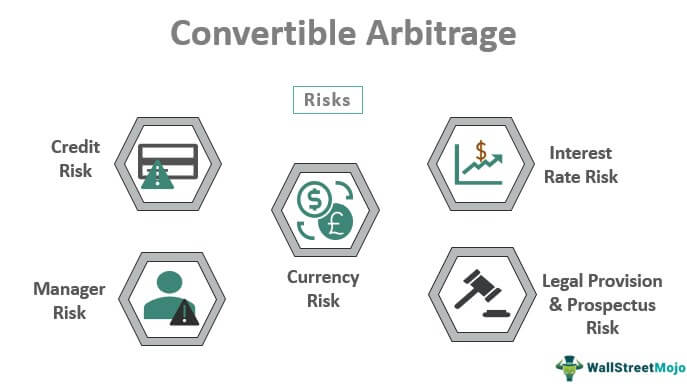

- Credit risk – The risk of loss of principal or loss of a financial reward stemming from a borrower’s failure to repay a loan or otherwise meet a contractual obligation.

- Currency risk – A form of risk that arises from the change in price of one currency against another.

- Deflation risk – A general decline in prices, often caused by a reduction in the supply of money or credit.

- Economic risk – the likelihood that an investment will be affected by macroeconomic conditions such as government regulation, exchange rates, or political stability.

- Hedging risk – Making an investment to reduce the risk of adverse price movements in an asset.

- Inflation risk – The uncertainty over the future real value (after inflation) of your investment.

- Interest rate risk – Risk to the earnings or market value of a portfolio due to uncertain future interest rates.

- Legal risk – risk from uncertainty due to legal actions or uncertainty in the applicability or interpretation of contracts, laws or regulations.

- Liquidity risk – The risks stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", CMP Program, finance, Glossary Terms, Marcinko Associates, Portfolio Management | Tagged: call risk, CMP, commodity risk, company risk, concentration risk, credit risk, currency risk, deflation risk, economic risk, finance, interest rate risk, Investing, investment, legal risk, liquiidity risk, Marcinko, MPT, personal-finance, return, systemic, unsystemic, volatility | Leave a comment »