By Staff Reporters

***

***

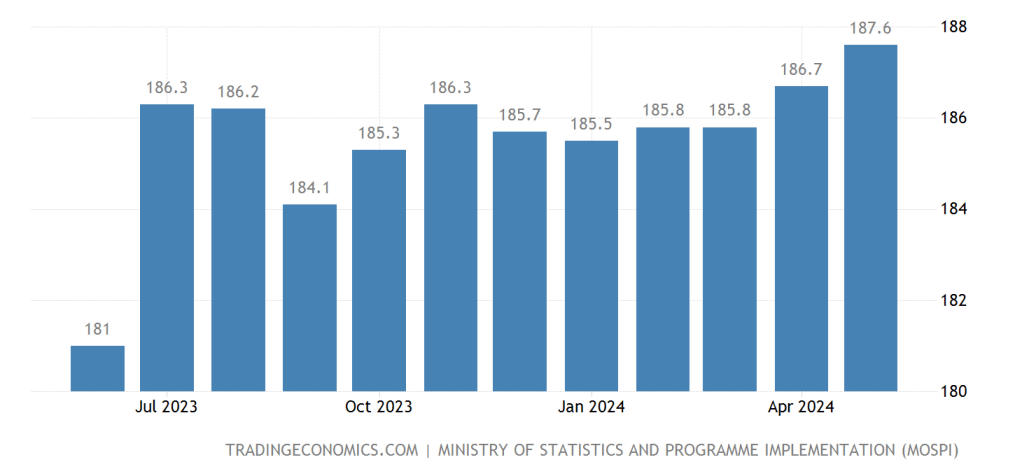

DEFINITION: Consumer confidence index (CCI) is a standardized confidence indicator providing an indication of future developments of households’ consumption and saving.

The index is based upon answers regarding household’s expected financial situation, their sentiment about the general economic situation, unemployment and capability of savings. An indicator above 100 signals a boost in the consumers’ confidence towards the future economic situation, as a consequence of which they are less prone to save, and more inclined to spend money on major purchases in the next 12 months. Values below 100 indicate a pessimistic attitude towards future developments in the economy, possibly resulting in a tendency to save more and consume less.

CITE: https://www.r2library.com/Resource

This indicator is measured as an amplitude adjusted index, long-term average = 100.

MORE: https://medicalexecutivepost.com/2024/08/28/

US consumer confidence hits a six-month high

The decline in inflation and the expectation of an imminent interest rate cut have Americans feeling better about the economy than they have in a while, according to the latest update of the Conference Board’s consumer confidence index [CCI].

On the other hand, consumers are worried about the softening labor market. While the unemployment rate remains below historical standards at 4.3%, it has increased for four straight months—likely enough to convince J. Powell and the Federal Reserve to cut rates in September.

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Funding Basics, Glossary Terms, LifeStyle | Tagged: CCI, CCI up, Consumer Confidence Index, Federal Reserve, FOMC, Jerome Powell | Leave a comment »