By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

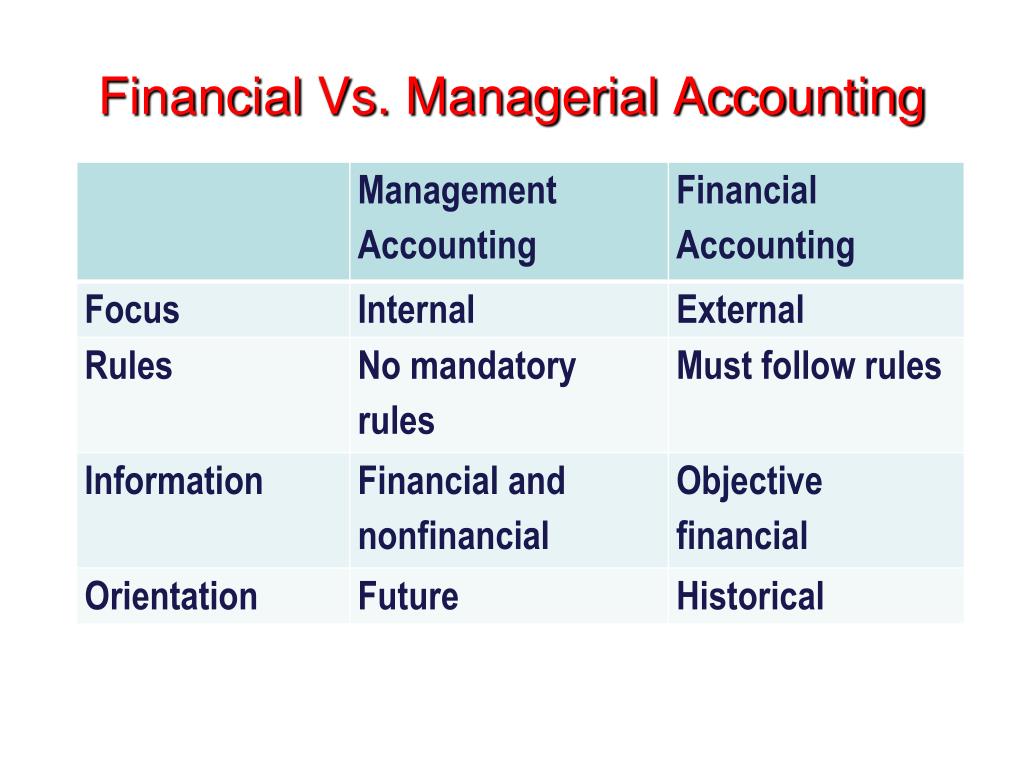

Financial accounting and managerial accounting are two distinct branches of the accounting field, each serving different purposes and stakeholders. Financial accounting focuses on creating external reports that provide a snapshot of a company’s financial health for investors, regulators, and other outside parties. Managerial accounting, meanwhile, is an internal process aimed at aiding managers in making informed business decisions.

Objectives of Financial Accounting

Financial accounting is primarily concerned with the preparation and presentation of financial statements, which include the balance sheet, income statement, and cash flow statement. These documents are meticulously crafted to reflect the company’s financial performance over a specific period, providing insights into its profitability, liquidity, and solvency. The objective is to offer a clear, standardized view of the financial state of the company, ensuring that external entities have a reliable basis for evaluating the company’s economic activities.

The process of financial accounting also involves the meticulous recording of all financial transactions. This is achieved through the double-entry bookkeeping system, where each transaction is recorded in at least two accounts, ensuring that the accounting equation remains balanced. This systematic approach provides accuracy and accountability, which are paramount in financial reporting. CPA = Certified Public Accountant.

Objectives of Managerial Accounting

Managerial accounting is designed to meet the information needs of the individuals who manage organizations. Unlike financial accounting, which provides a historical record of an organization’s financial performance, managerial accounting focuses on future-oriented reports. These reports assist in planning, controlling, and decision-making processes that guide the day-to-day, short-term, and long-term operations.

At the heart of managerial accounting is budgeting. Budgets are detailed plans that quantify the economic resources required for various functions, such as production, sales, and financing. They serve as benchmarks against which actual performance can be measured and evaluated. This enables managers to identify variances, investigate their causes, and implement corrective actions. Another objective of managerial accounting is cost analysis. Managers use cost accounting methods to understand the expenses associated with each aspect of production and operation. By analyzing costs, they can determine the profitability of individual products or services, control expenditures, and optimize resource allocation.

Performance measurement is another key objective. Managerial accountants develop metrics and key performance indicators (KPIs) to assess the efficiency and effectiveness of various business processes. These performance metrics are crucial for setting goals, evaluating outcomes, and aligning individual and departmental objectives with the overall strategy of the organization. CMA = Certified Managerial Accountant

Reporting Standards in Financial Accounting

The bedrock of financial accounting is the adherence to established reporting standards, which ensure consistency, comparability, and transparency in financial statements. Globally, the International Financial Reporting Standards (IFRS) are widely adopted, setting the guidelines for how particular types of transactions and other events should be reported in financial statements. In the United States, the Financial Accounting Standards Board (FASB) issues the Generally Accepted Accounting Principles (GAAP), which serve a similar purpose. These standards are not static; they evolve in response to changing economic realities, stakeholder needs, and advances in business practices.

For instance, the shift towards more service-oriented economies and the rise of intangible assets have led to updates in revenue recognition and asset valuation guidelines. The convergence of IFRS and GAAP is an ongoing process aimed at creating a unified set of global standards that would benefit multinational corporations and investors by reducing the complexity and cost of complying with multiple accounting frameworks.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Accounting, Financial Planning, Funding Basics, Glossary Terms, Taxation | Tagged: accountants, Accounting, balance sheet, budgeting, budgets, business, cash flows, Certified Managerial Accountant, certified public accountant, CMA, CPA, FASB, finance, financial accounting, Financial Accounting Standards Board, GAAP, IFRS, income statement, International Financial Reporting Standards, managerial accounting, managers, personal-finance | Leave a comment »