By Staff Reporters

***

***

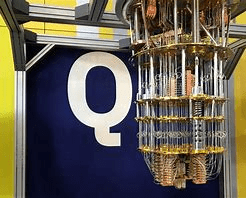

A quantum computer is a computer that exploits quantum mechanical phenomena. At small scales, physical matter exhibits properties of both particles and waves, and quantum computing leverages this behavior using specialized hardware. Classic physics cannot explain the operation of these quantum devices, and a scalable quantum computer could perform some calculations exponentially faster than any modern “classical” computer. In particular, a large-scale quantum computer could break widely used encryption schemes and aid physicists in performing physical simulations; however, the current state of the art is largely experimental and impractical.

The basic unit of information in quantum computing is the qubit, similar to the bit in traditional digital electronics. Unlike a classical bit, a qubit can exist in a superposition of its two “basis” states, which loosely means that it is in both states simultaneously. When measuring a qubit, the result is a probabilistic output of a classical bit. If a quantum computer manipulates the qubit in a particular way, wave interference effects can amplify the desired measurement results. The design of quantum algorithms involves creating procedures that allow a quantum computer to perform calculations efficiently and quickly.

Quantum Computing in Finance

Quantum-computing use cases in finance are slightly further in the future. The long-term promise of quantum computing in finance lies in portfolio and risk management.

CITE: https://www.r2library.com/Resource

One example could be quantum-optimized loan portfolios that focus on collateral to allow lenders to improve their offerings.

(Read more about how quantum computing could affect financial services.)

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Breaking News, Experts Invited, Information Technology, Investing, Risk Management | Tagged: bits, bytes, particles, portfolio, quantum, quantum computers, quantum computers finance, qubit, Risk Management, waves | Leave a comment »