By Staff Reporters

HEALTH SAVINGS ACCOUNT

***

***

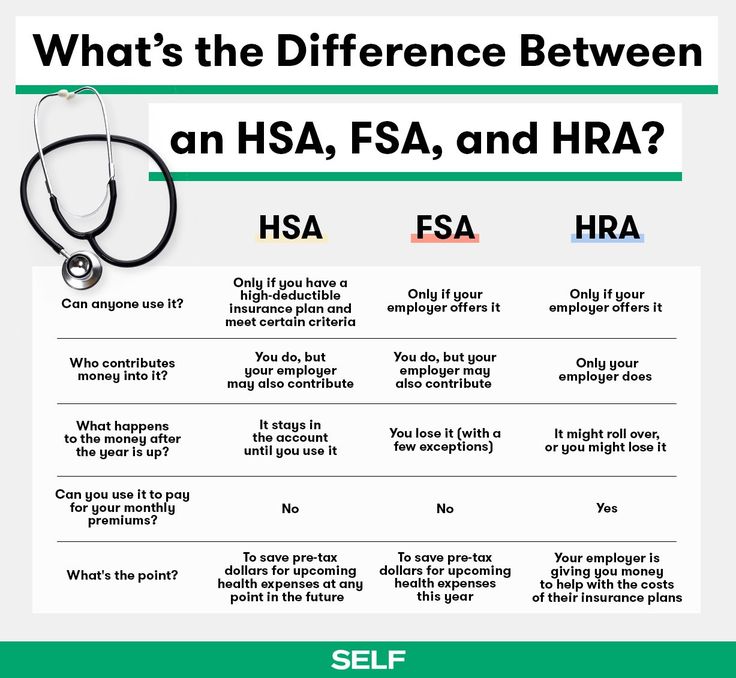

DEFINITION: According to Wikipedia, a health savings account (HSA) is a tax advantaged account available to taxpayers in the USA who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit.

Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. HSAs are owned by the individual, which differentiates them from company-owned Health Reimbursement Arrangements (HRA) that are an alternate tax-deductible source of funds paired with either high-deductible health plans or standard health plans.

CITE: https://www.r2library.com/Resource

How to avoid losing out on your HSA funds

The last thing you want is to risk losing out on the money you’ve socked away in an HSA. If you make a point to keep contributing to your account, however, then that alone should be enough to keep it active.

EXAMPLE: So let’s say your goal is to reserve all of your HSA funds for retirement, and you’re only in your 40s. If you make an HSA contribution every year, that should do the trick in keeping your account active. Making investment changes in your account might do the same.

If you have an old HSA you know you haven’t put money into for quite some time and you don’t plan to make a contribution or withdrawal anytime soon, then it could pay to contact the bank holding your HSA and confirm that you wish to keep your account active. At that point, your bank should be able to tell you what steps, if any, you need to take to make sure you don’t end up forfeiting any funds.

RELATED: https://medicalexecutivepost.com/2023/09/08/hsa-an-estate-planning-con/

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Financial Planning, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Investing, LifeStyle, Retirement and Benefits, Taxation | Tagged: flexible spending account, FSA, HDHP, health savings account, HRA, HSA |

Leave a comment