DEFINITION

Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

From Wikipedia, the free encyclopedia

***

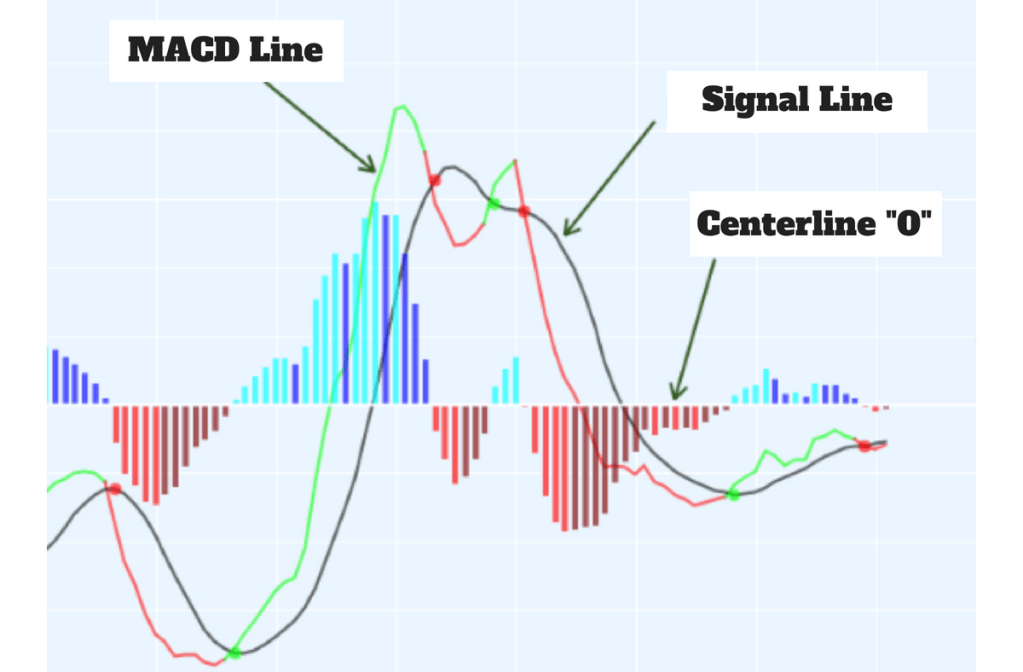

Example of historical stock price data (top half) with the typical presentation of a MACD(12,26,9) indicator (bottom half). The blue line is the MACD series proper, the difference between the 12-day and 26-day EMAs of the price. The red line is the average or signal series, a 9-day EMA of the MACD series. The bar graph shows the divergence series, the difference of those two lines.

***

MACD, short for moving average convergence/divergence, is a trading indicator used in technical analysis of securities prices, created by Gerald Appel in the late 1970s. It is designed to reveal changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

The MACD indicator (or “oscillator”) is a collection of three time series calculated from historical price data, most often the closing price. These three series are: the MACD series proper, the “signal” or “average” series, and the “divergence” series which is the difference between the two. The MACD series is the difference between a “fast” (short period) exponential moving average (EMA), and a “slow” (longer period) EMA of the price series. The average series is an EMA of the MACD series itself.

The MACD indicator thus depends on three time parameters, namely the time constants of the three EMAs. The notation “MACD(a,b,c)” usually denotes the indicator where the MACD series is the difference of EMAs with characteristic times a and b, and the average series is an EMA of the MACD series with characteristic time c. These parameters are usually measured in days. The most commonly used values are 12, 26, and 9 days, that is, MACD (12,26,9). As true with most of the technical indicators, MACD also finds its period settings from the old days when technical analysis used to be mainly based on the daily charts. The reason was the lack of the modern trading platforms which show the changing prices every moment. As the working week used to be 6-days, the period settings of (12, 26, 9) represent 2 weeks, 1 month and one and a half week. Now when the trading weeks have only 5 days, possibilities of changing the period settings cannot be overruled. However, it is always better to stick to the period settings which are used by the majority of traders as the buying and selling decisions based on the standard settings further push the prices in that direction.

Although the MACD and average series are discrete values in nature, but they are customarily displayed as continuous lines in a plot whose horizontal axis is time, whereas the divergence is shown as a bar chart (often called a histogram).

***

A fast EMA responds more quickly than a slow EMA to recent changes in a stock’s price. By comparing EMAs of different periods, the MACD series can indicate changes in the trend of a stock. It is claimed that the divergence series can reveal subtle shifts in the stock’s trend.

Since the MACD is based on moving averages, it is a lagging indicator. As a future metric of price trends, the MACD is less useful for stocks that are not trending (trading in a range) or are trading with unpredictable price action. Hence the trends will already be completed or almost done by the time MACD shows the trend.

COMMENTS APPRECIATED

Like, Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", curated experts,, finance, Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: Investing, finance, stock market, trading, Technical analysis, Moving Average Convergence/Divergence, MACD, lagging indicator, EMA | Leave a comment »