By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

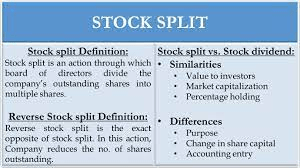

One important equity concept that medical professionals should be aware of is the idea of stock splits.

In a stock split, a corporation issues a set number of shares in exchange for each share held by share holders. Typically, a stock split increases the number of shares owned by a shareholder.

CITE: https://www.r2library.com/Resource

For example, XYZ Corp. may declare a 2-for-1 split, which means that share holders will receive two shares for each share that they own. However, corporations can also declare a reverse stock split, such as a 1-for-2 split where shareholders would receive 1 share for every two shares that they own.

While stock splits can either increase or decrease the number of shares that a share holder owns, the most important thing to understand about stock splits is that they have no impact on the aggregate value of the shareholder’s position in the company.

Using the XYZ Corp. example above, if the stock is trading at $10 per share, an investor owning 100 shares has a 24 total position of $1,000. After the 2-for-1 split occurs the investor will now own 200 shares, but the value of the stock will adjust downward from $10 per share to $5 per share.

Thus, the investor still owns $1,000 of XYZ stock. While stock splits are often interpreted as signals from management that conditions in the company are strong, there is no intrinsic reason that a stock split will result in subsequent stock appreciation.

NVIDIA Splits: https://tinyurl.com/238yze4k

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Accounting, Glossary Terms, Health Economics, Healthcare Finance, Investing, Marcinko Associates, Touring with Marcinko | Tagged: david marcinko, equity investing, Marcinko, Nvidia, physician investors, reverse stock splits, stock dividends, stock splits | Leave a comment »