By Staff Reporters and IRS

***

***

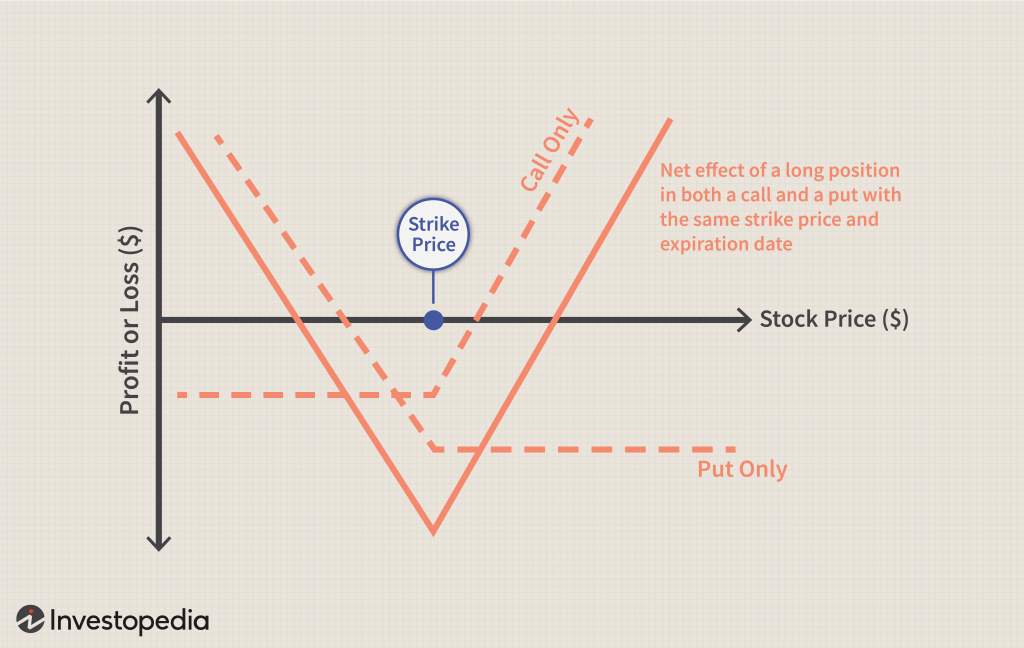

Straddles: A straddle is any set of offsetting positions on personal property. For example, a straddle may consist of a purchased option to buy and a purchased option to sell on the same number of shares of the security, with the same exercise price and period.

Personal property.

This is any actively traded property. It includes stock options and contracts to buy stock but generally does not include stock.

Straddle rules for stock.

Although stock is generally excluded from the definition of personal property when applying the straddle rules, it is included in the following two situations.

- The stock is of a type that is actively traded, and at least one of the offsetting positions is a position on that stock or substantially similar or related property.

- The stock is in a corporation formed or availed of to take positions in personal property that offset positions taken by any shareholder.

Note

For positions established before October 22, 2004, condition 1 above does not apply. Instead, personal property includes stock if condition 2 above applies or the stock was part of a straddle in which at least one of the offsetting positions was:

- An option to buy or sell the stock or substantially identical stock or securities,

- A securities futures contract on the stock or substantially identical stock or securities, or

- A position on substantially similar or related property (other than stock).

Position

A position is an interest in personal property. A position can be a forward or futures contract or an option.

An interest in a loan denominated in a foreign currency is treated as a position in that currency. For the straddle rules, foreign currency for which there is an active inter bank market is considered to be actively traded personal property.

Offsetting position

This is a position that substantially reduces any risk of loss you may have from holding another position. However, if a position is part of a straddle that is not an identified straddle, do not treat it as offsetting to a position that is part of an identified straddle.

Presumed offsetting positions

Two or more positions will be presumed to be offsetting if:

- The positions are established in the same personal property (or in a contract for this property), and the value of one or more positions varies inversely with the value of one or more of the other positions;

- The positions are in the same personal property, even if this property is in a substantially changed form, and the positions’ values vary inversely as described in the first condition;

- The positions are in debt instruments with a similar maturity, and the positions’ values vary inversely as described in the first condition;

- The positions are sold or marketed as offsetting positions, whether or not the positions are called a straddle, spread, butterfly, or any similar name; or

- The aggregate margin requirement for the positions is lower than the sum of the margin requirements for each position if held separately.

Related persons

To determine if two or more positions are offsetting, you will be treated as holding any position your spouse holds during the same period. If you take into account part or all of the gain or loss for a position held by a flow-through entity, such as a partnership or trust, you are also considered to hold that position.

COMMENTS APPRECIATED

Refer, Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Funding Basics, Glossary Terms, Risk Management | Tagged: Accounting, call, finance, Investing, Investopedia, IRS, long position, loss, personal property, personal-finance, profit, put, related persons, Risk Management, stock market, stock price, stocks, straddles, tax, Taxation | Leave a comment »