Living with Ambiguity [Is it Friend or Foe?]

By Robert Klosterman CFP® http://www.whiteoakswealth.com/

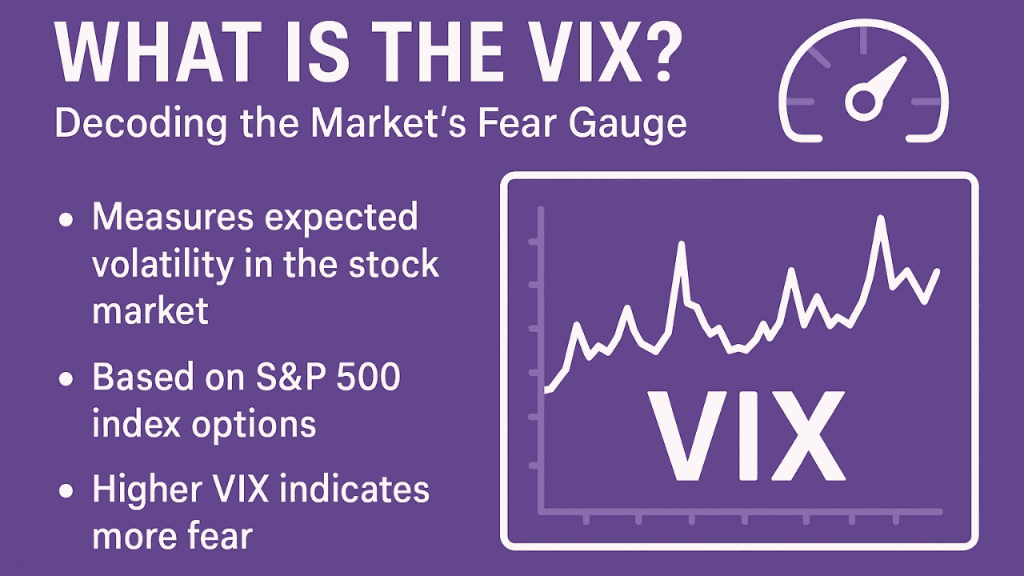

The stock market was down a bit last month and up last week, and then down today; back and forth, rising and falling and rising again the last few years, etc, etc.

Now: 23 557 DJIA

Whipsaw is the word I’ve heard to describe it lately. And, without a doubt, the question that gets asked the most is “How do you like this volatility?”

My reply, without exception, is “I LOVE volatility. I do prefer upside volatility to downside though”. The response is a smile or an outright laugh. Of course, few physicians or laymen I have ever met get worried about upside price movements in investing.

Third Quarter 2017

The third quarter of 2017 – post election results – clearly experienced both major up and downside volatility with the recent emphasis on the upside. Investors that fully invested in equities saw their portfolios rise in the positive and record-breaking direction.

Europe

The market pundits have a daily hero to pin the market movements on. Europe, Syria, Russia and Putin, Turkey, Greece, US Congress stalemates and other forces like the death of Fidel Castro are some of the most recent “good guys” that have given rise to Mr. Market’s positivity. Did we mention Donald Trump?

How Long?

The bigger question is how long will these issues persist? Established societies, often described as western economies, have some significant headwinds facing them for the next few years: high debt, mounting costs of social insurance programs, and the likelihood of higher taxes to solve the problems.

There is nothing new or unique about that last sentence. There seems to be a wide consensus on those points and coupled with the record low interest rates, investors seem to have few traditional options to consider. It appears likely that it will take a few years to resolve these issues and provide a platform for above average growth.

Strategies

There are a number of strategies that can utilize volatility including Long-Short, Mean Reversion, Managed Futures and Market Neutral, etc [previously noted on this ME-P]. These provide returns in a secular bear market that may continue for a few more years.

Link: https://medicalexecutivepost.com/2007/11/28/what-is-a-market-neutral-fund/

It’s also important to recognize that while the US and Western Europe maybe having to face the headwinds there are economies in parts of the world that will likely experience above average growth rates for the next few years. For the most part, these emerging markets include Brazil, Russia, India and China (BRIC). A strong dollar not-withstanding.

BRIC Analogs to the USA

In the 1870‘s, the US was an emerging market the same way the BRIC economies are today’s emerging markets; developmentally analogous. Whereas the US and Western Europe face many headwinds, some of these emerging economies actually have wind in their backs. Trade surplus, demographics, low debt and low cost of Government are some of the key advantages. These countries’ standard of living is changing to the positive, and they have a large percentage of their population that can move up and be a purchaser of goods and services where previously they could not.

Income Generation

Another important focus will be on income generation. For many years the income portion of an investment in equities was half or more of its return. Only in recent years has the largest portion come from capital gains. We are likely “back to the old days” in order to achieve returns that will offset inflation and meet longer-term investment goals

Opportunities exist in a variety of areas, including real estate, Mortgage Backed Securities, Private Equity and others to have more focus on income as a dominant portion of the total return.

Assessment

Volatility is going to be with us and it would be wonderful to have the confidence needed to say the emphasis would be on upside volatility, but that is not the case right now. The optimum strategies are to align portfolios with the world we live in today.

IOW: Doctors, medical professionals and all investors must learn to “live with ambiguity.”

About the Author

Robert J. Klosterman® has been listed as one of the Top 250 Financial Advisors in the United States by Worth Magazine. He has also been recognized as one of the top 150 Financial Advisors by Mutual Fund Magazine, Medical Economics and Bloomberg’s Wealth Manager Magazine. Bob’s published quotes appear frequently in dozen’s of local and national publications, including USA Today, the New York Times, Minneapolis Star Tribune, CFP Today, Barron’s and Fortune.

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

***

***

Filed under: Investing | Tagged: BRIC, Investing, Long-Short, Managed Futures, Market Neutral Funds, Mean Reversion, Mortgage Backed Securities, Private Equity, Robert Klosterman, Stock Market Volatility | 3 Comments »