DEFINITION

By Staff Reporters

***

***

1035 Exchange

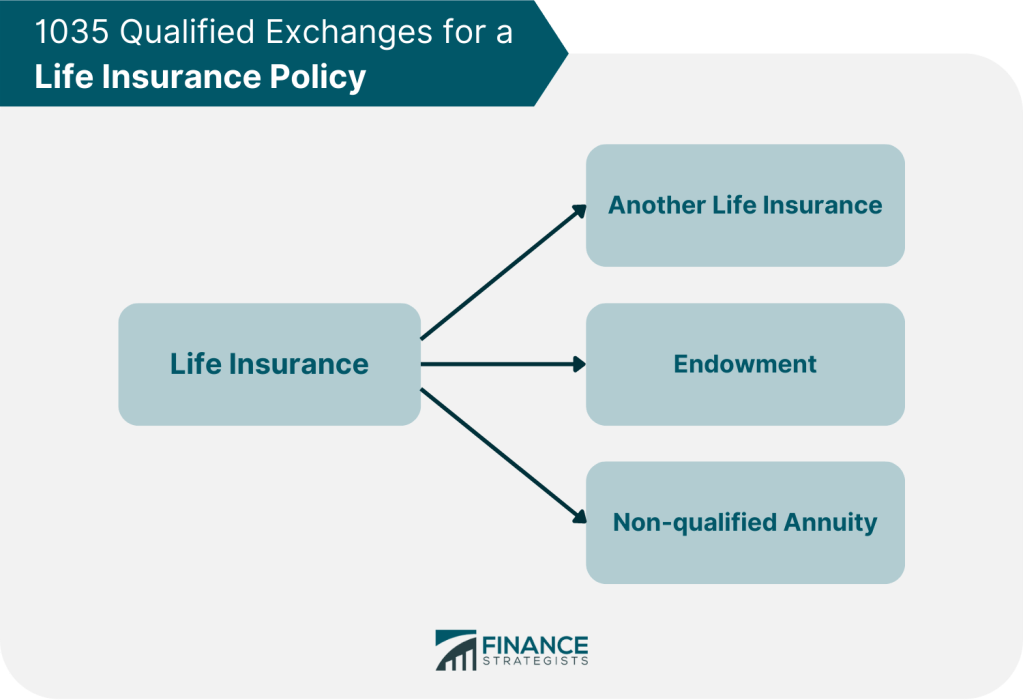

DEFINITION: A method of exchanging insurance-related assets without triggering a taxable event. Cash-value life insurance policies and annuity contracts are two products that may qualify for a 1035 exchange.

***

A 1035 exchange is a feature in the tax code that permits individuals to transfer funds from an existing life insurance endowment, or annuity policy to a new one without tax consequences.

The IRS permits these like-kind trades under Internal Revenue Code section 1035, where this process takes its name from.

These transactions are not subject to tax deductions or tax credits but rather tax deferrals, meaning that individuals would only pay taxes on any earnings once they receive money from the policy later.

Without this provision, policyholders would have to close their previous accounts and be subjected to both taxes and surrender charges before they could open a new account.

Cite: https://www.annuity.org/annuities/1035-exchange/

COMMENTS APPRECIATED

Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Funding Basics, Glossary Terms, Insurance Matters, Investing, Risk Management | Tagged: 1035, 1035 exchange, annuities, annuity, cash value insurance, endowment, Financial Planning, insurance, IRS, IRS 1035, life insurance, lifeinsurance, non-qualified annuity, personal-finance, qualified exchange | Leave a comment »