By Staff Reporters

***

***

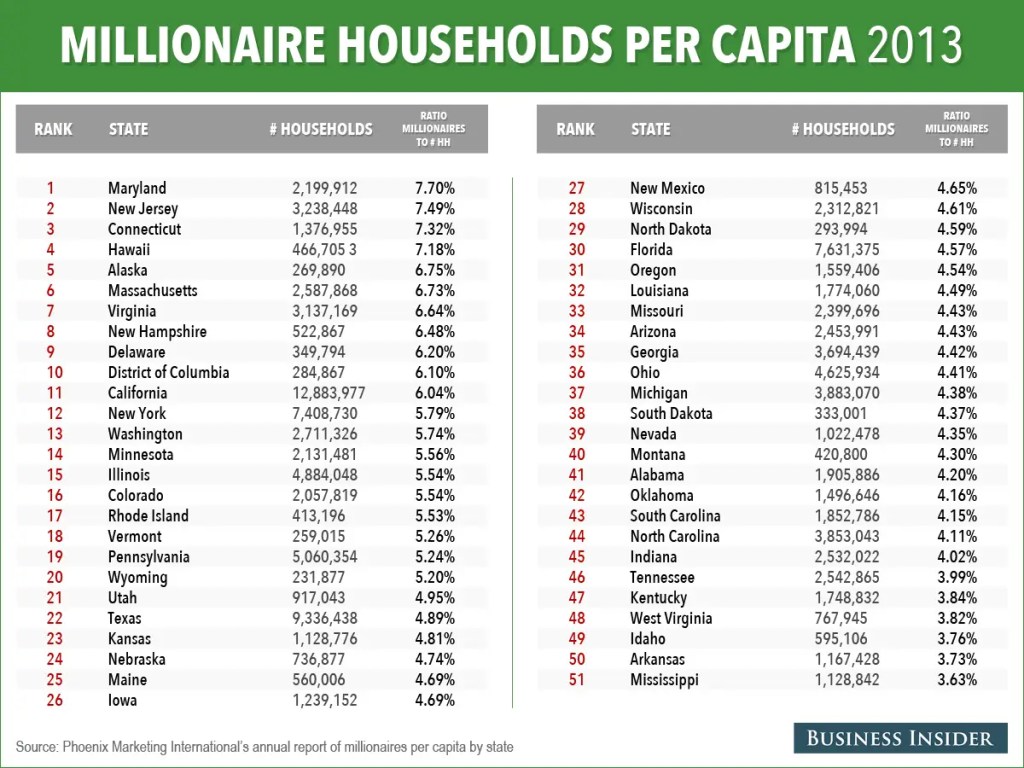

It seems many of America’s millionaires are saving for retirement. Thanks largely to a stock market, the number of 401(k) millionaires hit a new record last quarter—rising 2.5% to 497,000, as per Fidelity. It was the third quarter in a row of growth for retirement savings, Quartz reports, and the average amount in retirement accounts hit $127,100.

CITE: https://www.r2library.com/Resource

But even those who have made it to the $1 million mark haven’t quite hit the figure most Americans think they need to retire comfortably. That’d be $1.46 million, according to the latest survey by Northwestern Mutual.

COMMENTS APPRECIATED

Thank You

***

***

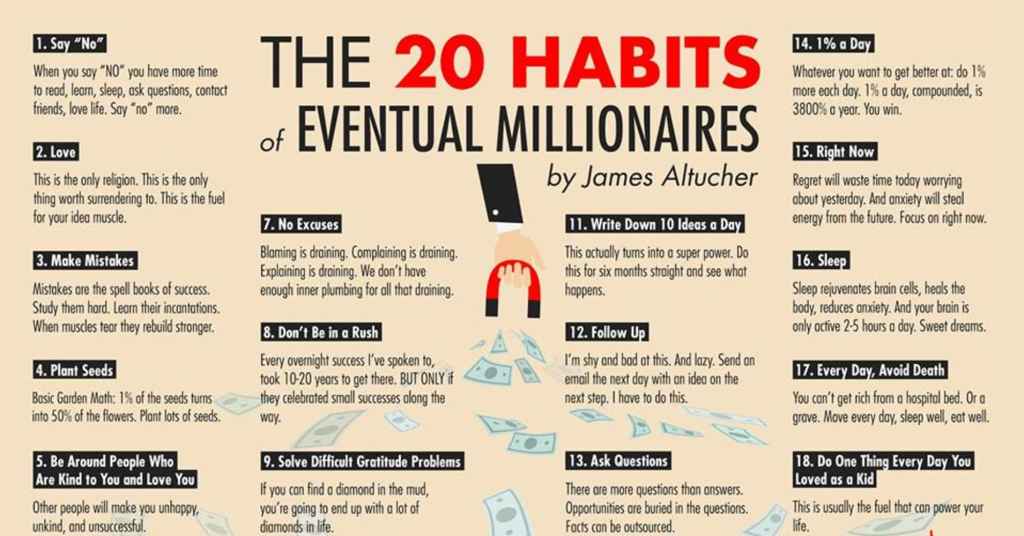

Filed under: "Ask-an-Advisor", Accounting, Career Development, Events-Planner, Financial Planning, Funding Basics, Health Economics | Tagged: Fidelity, james altucher, millionaire mindset, Millionaires, Northwestern Mutual, Quartz | Leave a comment »