DEFINITION

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

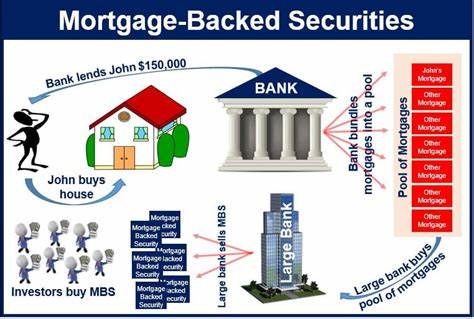

Prepayment risk is typically used in reference to mortgage-backed securities. It refers to the risk that mortgage refinancing activity might increase when market interest rates decline, which is generally not favorable for MBS investors.

For example, when homeowners refinance their mortgages, MBS investors are “prepaid,” shortening the life of their investments and forcing investors to reinvest the proceeds under lower interest rate conditions than what were most likely prevailing at the time of the original MBS investment.

Price adjustments for prepayment risk are one factor that helps explain why MBS, despite their generally high credit quality, have higher yields than comparable-maturity Treasury securities.

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Funding Basics, Glossary Terms, iMBA, iMBA, Inc., Investing, Marcinko Associates, Mortgage Electronic Registry System, Taxation, Touring with Marcinko | Tagged: iMBA, Institute Medical Business Advisors, Marcinko, mbs, medical executive post, mortgage-backed securities., prepayment risk, treasury securities | Leave a comment »