Doctors Acting as Lenders, White-Knights and Venture Capitalists

By Rick Kahler CFP® http://www.KahlerFinancial.com

Every now and then I get a call from a doctor client wanting my opinion about starting a business with a friend, investing money in a business owned by a family member, or co-signing a loan to help a family member buy a business. Being in business with family is something I know a little bit about, having been in partnership with my father and brother for 40 years. Going into business with family members or close friends can carry a high degree of risk, both financially and emotionally.

In part this is because it is uncomfortable or difficult to ask the necessary dollars-and-cents questions. We don’t want to seem uncaring, unsupportive, or untrusting. We are concerned about damaging the relationship. Yet the relationship is far more likely to suffer if we don’t ask those questions and the venture fails.

My Rules

The following are some things to consider before you invest or go into business with someone close to you:

1. Don’t even consider putting money into a business without seeing a detailed business plan. Ask the same questions about risks, costs, and potential profits that you would ask if this person were not a family member.

2. Insist that the person at least talk to other possible investors who aren’t emotionally involved. This will give both of you some feedback from neutral third parties about the validity of the opportunity. A banker or a potential investor who isn’t a family member will ask questions you may not even think of asking.

3. Do your own research and seek out some independent advice. A financial advisor or someone with a lot of business experience can be a valuable source of questions, information, and alternatives.

4. Ask yourself whether you want to be involved in this business. Does it support your own goals? Do you know anything about this field or have any interest in it? Sometimes people invest on behalf of family members because they feel they “should.” Yet, had those same proposals come from acquaintances or business colleagues, they would almost certainly have said no without a second thought.

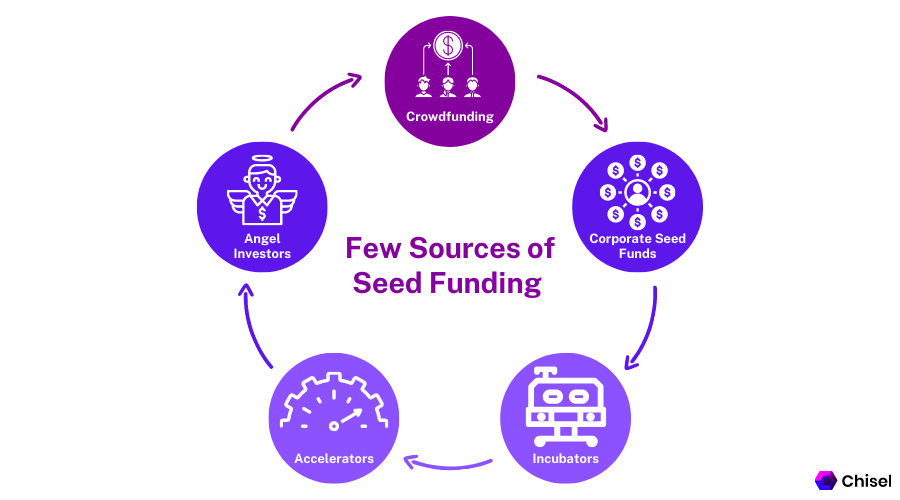

5. Try to think of other ways you might be supportive without putting money into the venture. Maybe you can think of lower-risk alternatives or other possible sources of funding. Remember, too, that if your wish is to support and encourage family members, helping them jump into an unacceptably risky investment isn’t exactly doing them any favors.

6. Pay close attention to any difficult feeling you are experiencing when considering investing in this enterprise. Explore any feelings like fear, anxiety, or sadness to determine if there is further wisdom to be gleaned. Perhaps you may be unconsciously ignoring some crucial warning signs.

7. Communicate clearly. Emphasize from the beginning that protecting the relationship is your most important consideration. If you decide not to get involved, be direct about it. Saying no right away is more respectful than is stringing the person along because you don’t want to hurt someone’s feelings. Yes, choosing not to invest in a family member’s project may cause some tension in the relationship. That’s minor compared to the damage the relationship could incur if you invest and the business fails.

###

Assessment

Sometimes, the best way for a successful doctor to support a family member’s financial well-being is to turn down an investment request. If outside parties are not willing to commit funds to a project, maybe there’s a message there that both of you need to hear. If you wouldn’t make an investment on its own merits, you almost certainly shouldn’t make it just because it involves a friend or family member.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Hospitals: http://www.crcpress.com/product/isbn/9781439879900

Physician Advisors: www.CertifiedMedicalPlanner.org

Filed under: "Doctors Only", Funding Basics, Risk Management | Tagged: funding, lenders, Rick Kahler CFP®, venture capitalists, White-Knights | 2 Comments »