By A.I. and Staff Reporters

***

***

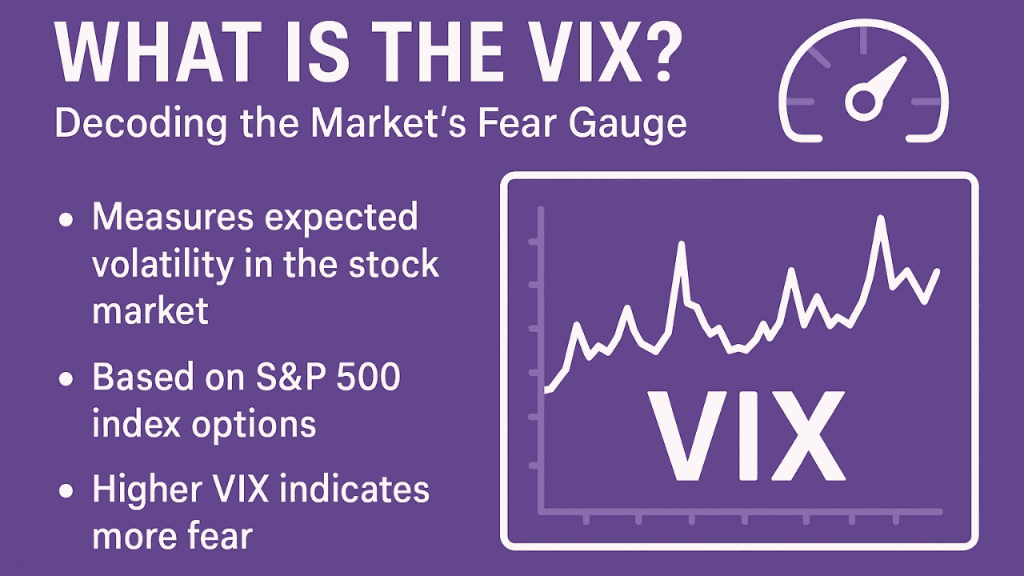

The VIX, or CBOE Volatility Index, is often called the “fear gauge” of the stock market. It measures the market’s expectations for volatility over the next 30 days, based on options prices for the S&P 500.

MORE: https://medicalexecutivepost.com/2025/06/30/vix-fear-index-down/

When the VIX is high, it typically signals investor anxiety or uncertainty; when it’s low, it suggests confidence and stability.

Current VIX Snapshot 10/12/25

- Price: $21.66 USD

- Change: +5.23 (up 31.83%)

- Previous Close: $16.43 USD

- Mike Burry: https://www.msn.com/en-us/money/markets/michael-burry-warns-of-a-market-collapse-ahead/ar-AA1Oi09s?ocid=U521DHP&pc=U521&cvid=68eab56ca2074b65b06724e8838f8c7a&ei=19

COMMENTS APPRECIATED

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Glossary Terms, Portfolio Management | Tagged: CBOE, fear gauge, S&P 500, stock market, VIX | Leave a comment »