SPONSOR: http://www.CertifiedMedicalPlanner.org

By Staff Reporters

***

***

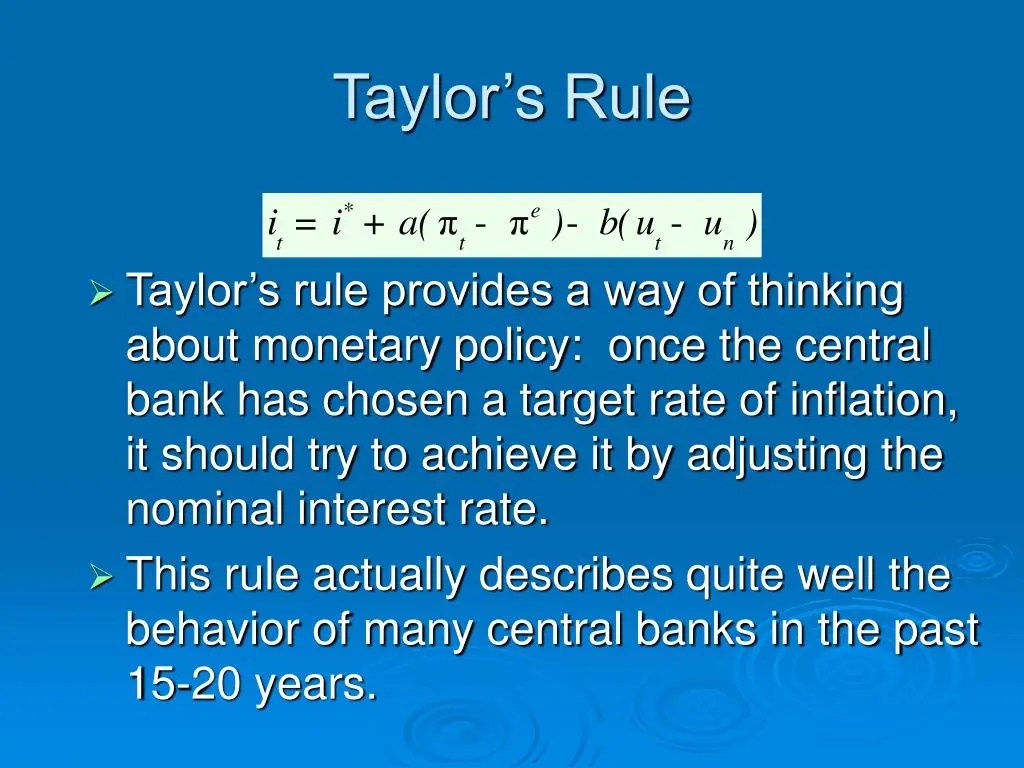

Named for a U.S. economist, the JB Taylor Rule is a mathematical monetary-policy formula that recommends how much a central bank should change its nominal short-term interest rate target (such as the U.S. Federal Reserve’s federal funds rate target) in response to changes in economic conditions, particularly inflation and economic growth. It’s typically viewed as guideline for raising short-term interest rates as inflation and potentially inflationary pressures increase. The rule recommends a relatively high interest rate (“tight” monetary policy) when inflation is above its target or when the economy is above its full employment level, and a relatively low interest rate (“easy” monetary policy) under the opposite conditions.

To illustrate, the monetary policy of the FOMC changed throughout the 20th century. The period between the 1960s and the 1970s is evaluated by Taylor and others as a period of poor monetary policy; the later years typically characterized as stagflation. The inflation rate was high and increasing, while interest rates were kept low. Since the mid-1970s monetary targets have been used in many countries as a means to target inflation.

However, in the 2000s the actual interest rate in advanced economies, notably in the US, was kept below the value suggested by the Taylor rule.

COMMENTS APPRECIATED

Like and Refer

***

***

Filed under: "Ask-an-Advisor", CMP Program, Financial Planning, Glossary Terms, Investing | Tagged: central bank, CMP, easy monitary policy, fed, Federal Reserve, FOMC, inflation target, interest rates, John B. Taylor, monetary policy, stagflation, tight monetary policy | Leave a comment »