DEFINITION

By Staff Reporters

***

***

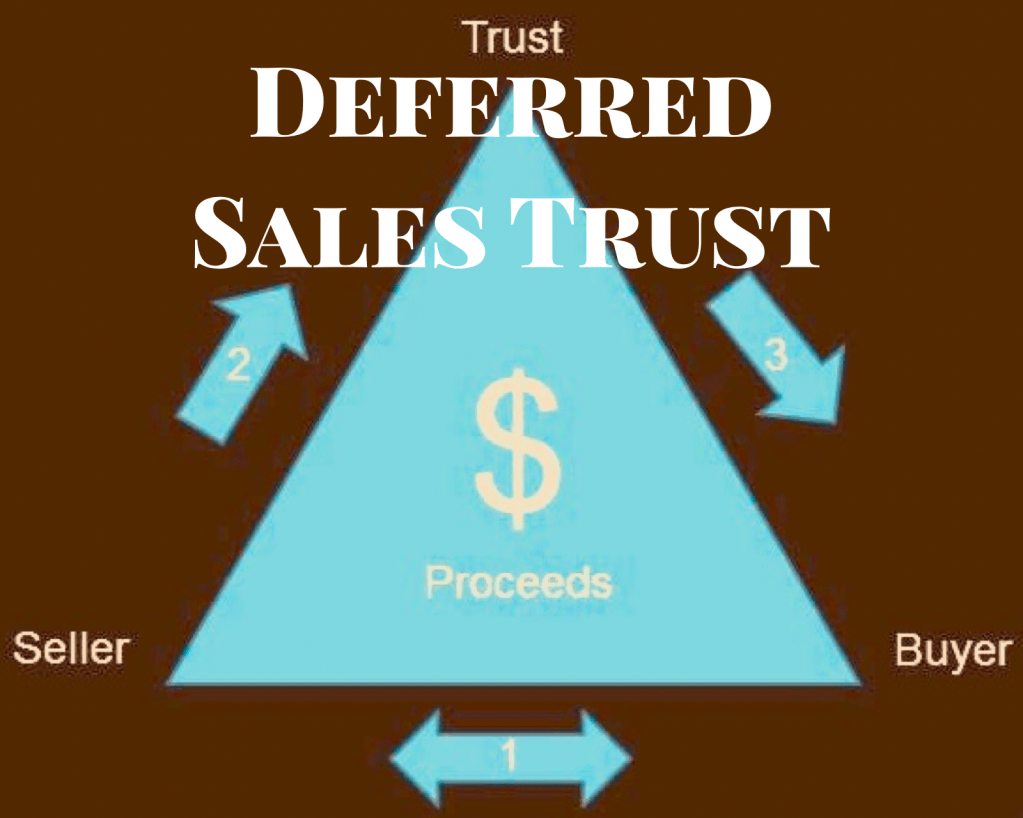

A deferred sales trust (DST) is an advanced tax strategy that allows investors to delay capital gains taxes on the sale of assets that have significantly risen in value, such as real estate or businesses. By selling the asset to a trust, the seller can receive payments over time, spreading out tax liabilities and allowing the profits to grow tax-deferred.

For example, a business owner may sell their company to a DST, avoiding a large tax bill upfront and instead receive income over multiple years. However, DSTs can be complex, and there are often fees involved in setting up and maintaining the trust.

Now, let’s point out some of the pros and cons of Deferred Sales Trusts.

One potential positive feature of using an installment sale to defer your capital gains taxes rather than a 1031 exchange is that installment sales don’t come with the same strict guidelines that govern 1031 exchanges. In particular, in light of the Tax Cuts and Jobs Act of 2017, 1031 exchanges are restricted to real property, whereas Deferred Sales Trusts and other installment sale arrangements can be used to defer capital gains for any kind of asset.

Conversely, the IRS has provided little to no guidance on how to defer taxes using an installment sale.

The basic rationale behind why you don’t receive capital gain is that you are not profiting immediately from the sale made with a Deferred Sales Trust. Given this rationale, there are various constraints on how a Deferred Sales Trust must be organized so that no capital gains taxes are in fact realized.

- The third party to whom you transfer your asset generally cannot be a “related person” to you, such as a family member or a corporation in which you hold an interest. Except in special circumstances, if you attempt to set up a Deferred Sales Trust with a related person it will be viewed as a “sham trust” made just for the purposes of avoiding capital gains taxes, and will not be protected by the provisions in Section 453.

- As with the 1031 exchange, you, the seller, cannot at any point in the transfer of your asset be in constructive receipt of the proceeds from the third party’s sale of that asset. To successfully defer capital gains taxes, either the third party or the trust of which they are trustee must be the only party which receives cash in the sale of the transferred asset. This includes receipt of a bond which is payable on demand.

This has been a general, informal introduction to Deferred Sales Trusts. As always, before attempting to carry out any important financial decision, investors should consult with a qualified tax or legal advisor regarding the specifics of their situation.

COMMENTS APPRECIATED

Subscribe, Like and Share!

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Glossary Terms, Investing, Taxation | Tagged: 1031 Exchange, bond, capital gains, constructive receipt, deferred sales trust, Investing, IRS, real-estate, section 453, sham trust, Tax Cuts and Jobs Act of 2017, taxes | Leave a comment »