By AI

CBOE Volatility Index

***

***

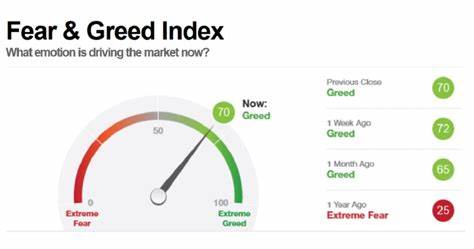

There’s a lot of confidence in markets these days, and nowhere is that more apparent than in the VIX, aka the CBOE Volatility Index, aka aka the Fear Index.

According to Brew Markets, the VIX literally measures the market’s expectation of volatility based on S&P 500 index options, but it’s become a shorthand way of quantifying investors’ fear or confidence. Any time the VIX rises above 30, it’s taken as a sign of some serious trepidation in the market—but anytime it falls below 20, the market is calm, cool, and collected.

The VIX skyrocketed to over 50 on Liberation Day as investors fretted over what tariffs meant for their portfolios, but it’s been gradually falling ever since. As the chart above shows, the VIX just fell below its key support level of 17—a mark it has failed to break below recently, and a move that underlines investors’ confidence that the good times will keep rolling.

VIX: https://medicalexecutivepost.com/2025/04/20/vix-stock-market-fear-gauge-update/

Whether or not that confidence is misplaced remains to be seen.

COMMENTS APPRECIATED

Subscribe, Refer and Like

***

***

Filed under: "Ask-an-Advisor", Breaking News, curated experts,, finance, Financial Planning, Glossary Terms, Investing, Portfolio Management, Touring with Marcinko | Tagged: Brew Markets, CBOE Volatility Index, fear index, liberation day, Marcinko, Portfolio Management, S&P 500, VIX |

Leave a comment