http://www.MarcinkoAssociates.com

By Staff Reporters

***

***

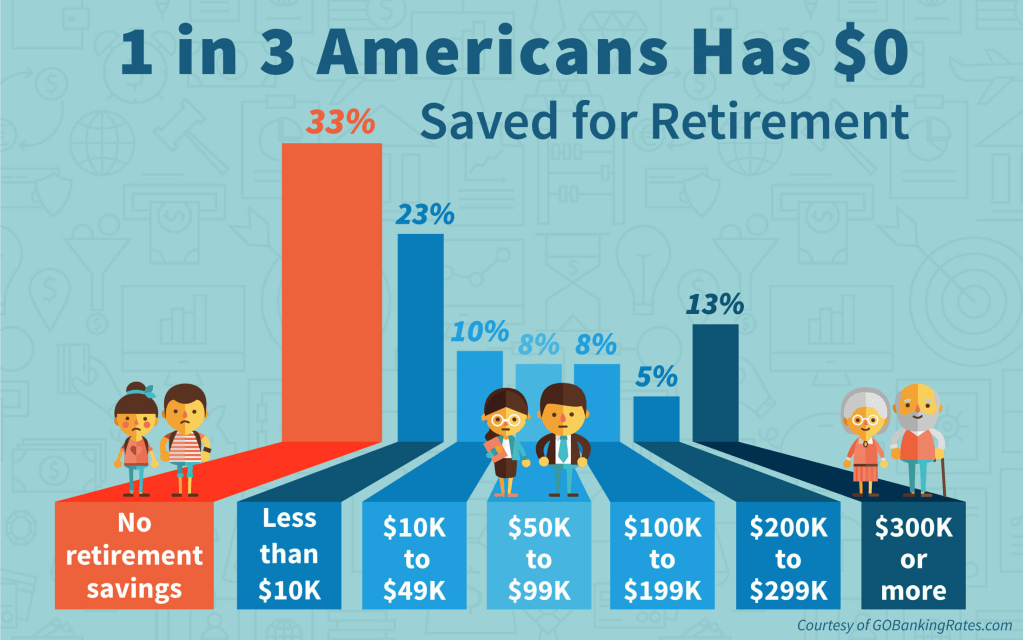

According to the National Institute on Retirement Security, almost 40 million households have no retirement savings at all. The Employee Benefit Research Institute (EBRI) estimates in its 2019 Retirement Security Projection Model that America’s current retirement savings deficit is $3.8 trillion.

What does that mean? Well, the EBRI report aggregates the savings deficit of all U.S. households headed by someone between the ages of 35 and 64, inclusive. In total, those households have $3.8 trillion fewer dollars in savings than they should have for retirement.

For more recent data, Fidelity Investments reported that in the third quarter of 2022 the average account balance for an IRA was $101,900. Employees with a 401(k) averaged $97,200, while those with a 403(b) had $87,400.

Fidelity also estimated that “an average retired couple age 65 in 2022 may need approximately $315,000 saved (after tax) to cover health care expenses in retirement.” Keeping in mind that more Americans are also living longer than ever before, they will face more challenges to cover medical expenses in retirement.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Breaking News, Ethics, Experts Invited, Financial Planning, Funding Basics, Investing, LifeStyle, Marcinko Associates, Retirement and Benefits, Touring with Marcinko | Tagged: EBRI, Employee Benefit Research Institute, Fidelity, iMBA, Marcinko, medical business advisors, medical executive post, National Institute on Retirement Securit, retirement, Retirement Income, Retirement Income US |

Leave a comment