RETIREMENT PLANNING

By Staff Reporters

***

***

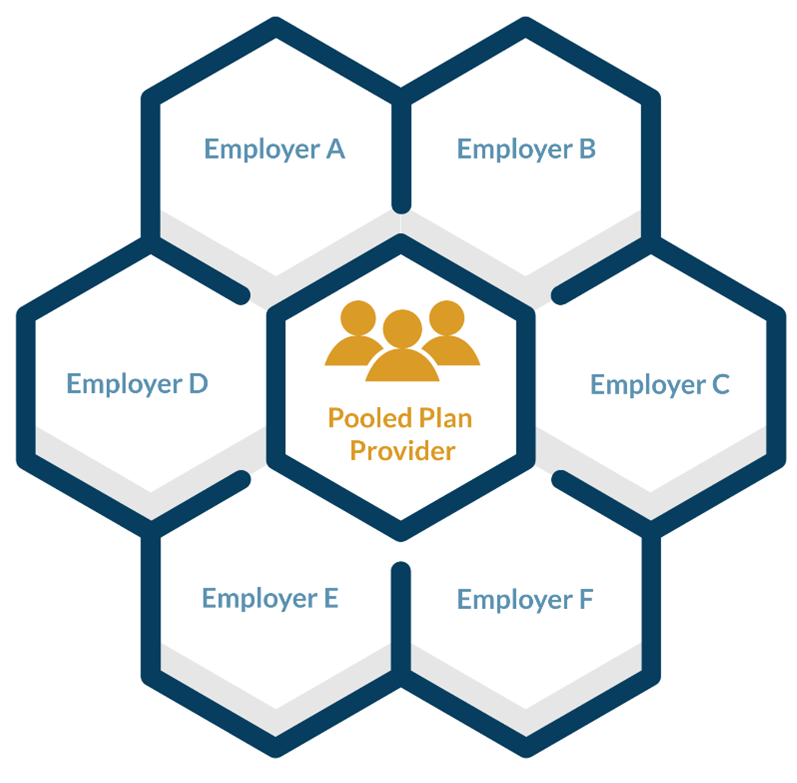

A PEP is a defined contribution plan, such as a 401(k), in which multiple employers can participate. When employers join a PEP, they delegate their named fiduciary role to a third-party pooled plan provider (PPP). PEP fiduciary oversight falls on the PPP rather than the employer. And although each PPP may set its own eligibility requirements, businesses joining a PEP benefit plan needn’t operate in the same industry or geographical area.

PEP plans provide viable 401(k) alternatives for small business owners who may otherwise struggle to compete for talent against large organizations with comprehensive benefits packages.

CITE: https://www.r2library.com/Resource/Title/082610254

Other advantages include: Less in-house administration: The PPP assumes responsibility for much of the plan administration, handling all plan documentation, governmental filings and ongoing compliance. Employee payroll deductions are left to the employer, but these can be efficiently managed with the help of a payroll service provider that integrates payroll and benefits.

Tax credits can help offset PEP start-up costs. For the first three years of participation, employers may be eligible for a tax credit of $5,000 annually, with an additional $500 available to those who set up automatic enrollment. Under Secure Act 2.0, an additional credit of up to $1,000 per employee for eligible employer contributions may apply to employers with up to 50 employees for the preceding taxable year. This credit phases out from 51 to 100 employees.

Businesses participating in single-employer retirement plans (SEP) must independently communicate and coordinate with their record-keeper, custodian, investment advisor, trustee and auditor. With PEP, all these tasks and services are bundled into one, saving employers time and money.

Despite its advantages, a PEP does have some drawbacks, particularly when compared to an SEP. Unlike a PEP, an SEP gives employers more of the following:

- Flexibility: Employers can customize the design of their plan to meet their retirement goals and the needs of their employees.

- Control: Employers are not dependent on the actions or decisions of others and can access information and resolve problems directly without the need of a third party.

- Choice: Employers have the unilateral freedom to choose a different service provider, move their plan or negotiate better pricing if they are unsatisfied with the cost or quality of service.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Funding Basics, Investing, Practice Management, Professional Liability, Retirement and Benefits, Risk Management, Taxation | Tagged: 401(k), DCP, defined contribution plan, fiduciary, payroll, payroll benefits, PEP, pooled employer plan, pooled plan provider, PPP, retirement planning, SEP |

Leave a comment