Mobile money, mobile money transfers and mobile wallets

By Staff Reporters

***

***

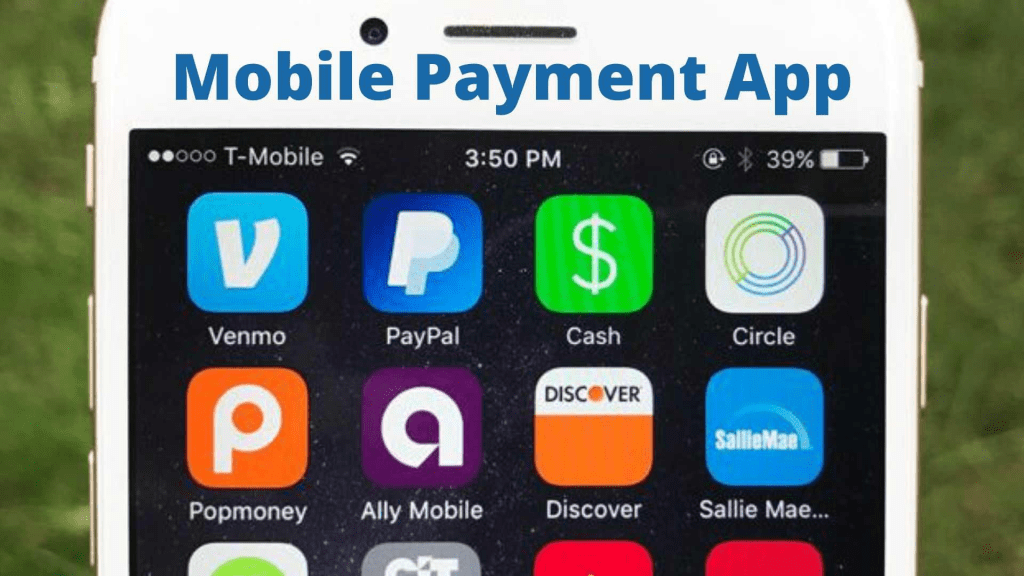

DEFINITION: A mobile payment, also referred to as mobile money, mobile money transfer and mobile wallet, is any of various payment processing services operated under financial regulations and performed from or via a mobile device, as the cardinal class of digital wallet. Instead of paying with cash, cheque, or credit cards, a consumer can use a payment app on a mobile device to pay for a wide range of services and digital or hard goods. Although the concept of using non-coin-based currency systems has a long history, it is only in the 21st century that the technology to support such systems has become widely available.

Mobile payments began adoption in Japan in the 2000s and later all over the world in different ways. The first patent exclusively defined “Mobile Payment System” was filed in 2000.

Don’t use Mobile Payment Services to Park Cash, CFPB Warns.

Venmo may not be that much better than stuffing bills under your mattress when it comes to keeping your money safe long term, the Consumer Financial Protection Bureau recently cautioned.

The app and others, like CashApp, Apple Pay, and PayPal, aren’t banks, so the Federal Deposit Insurance Corporation doesn’t provide insurance for funds stored there, the CFPB pointed out. The agency said there are billions of dollars at risk if these apps suffer an SVB-like bank failure.

***

***

***

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Advisors Only", Financial Planning, Funding Basics, Information Technology, Insurance Matters, Investing | Tagged: Apple Pay, banks, CFPB, Consumer Financial Protection Bureau, FDIC, FDIC insurance, mobile money, mobile money transfer, mobile money transfer and mobile, Mobile Payment Apps, Mobile Payments, mobile wallet, PAYPAL, SVB, Venmo | Leave a comment »