Insurance Basics for Medical Professionals

By Jeffrey H. Rattiner, CPA, CFP®, MBA via iMBA, Inc.

After determining the need for insurance and the amount to purchase, the doctor-client and financial planner’s next task is to match those needs to the client’s objectives to determine what type of policy the client should purchase. The life insurance industry features more products today than ever before. One reason for this change is that, clearly, the insurance industry has expanded its product base to become more competitive. Another reason is that clients’ needs are constantly changing and the insurance companies must keep up with those needs or run the risk of having funds withdrawn from their companies. New and different types of life insurance products are here to stay. Since life insurance represents a significant part of a client’s risk-management program, planners have to be versed in the specifics of the varied product base.

Term Insurance Alternative

Whole life insurance was introduced as an alternative to term insurance. Whole life is often called cash value insurance or permanent insurance to distinguish it from term insurance. The cash value in whole life insurance arises because of the level premium system and the need to account for prepaid premiums. Whole life insurance offers permanent protection at a level premium for the entire lifetime of the insured. Premiums remain fixed and are paid throughout the insured’s entire lifetime. The premium level can remain constant throughout the life of the policy because premiums are higher during the early years. The excess charge in the early years makes it possible to build up a reserve, which will be needed, together with interest earned, to keep premiums level throughout the life of the policy. Older clients then pay the same premium in later years as they did when they were younger.

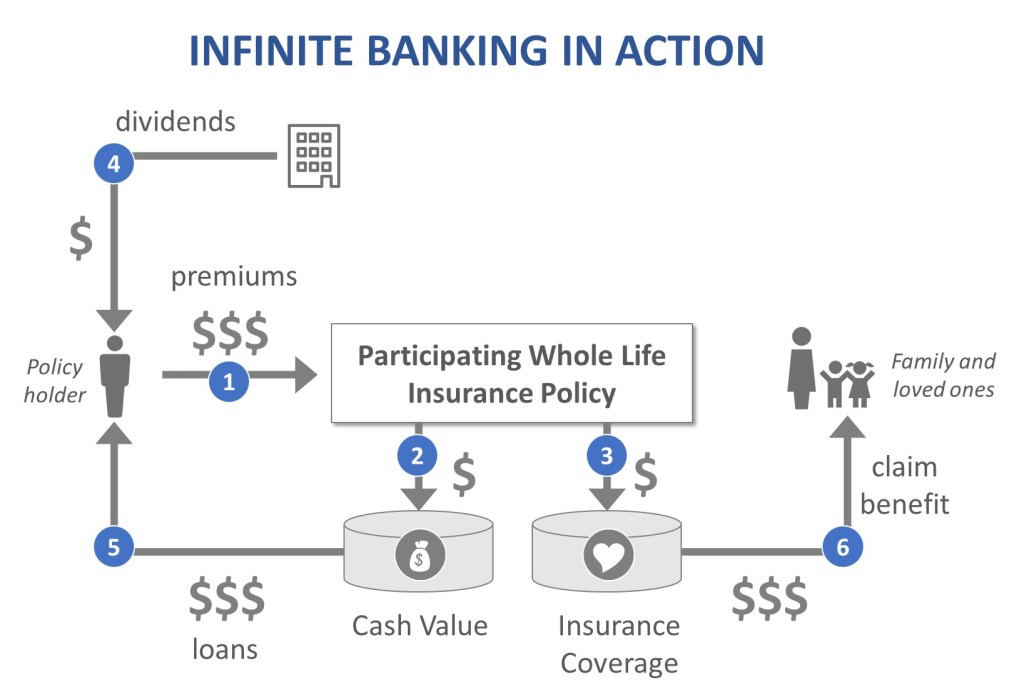

Cash Value

The cash value of a whole life policy serves a variety of purposes:

• It can be used for collateral for an insurance company loan.

• If the insured decides to terminate the policy, he or she can elect to receive the policy’s cash value at that time.

• The cash value balance can be remitted to the insurance company to purchase a reduced paid-up insurance policy. This will provide coverage until the funds are insufficient to pay the premiums. This cancellation feature is also referred to as a non-forfeiture value.

• If the policy is not canceled, the accumulated cash value becomes part of the death benefit paid upon the insured’s death (which makes this type of policy similar to a decreasing term policy). It can reduce cash flow by taking some of the investment results out of the contract either through dividends or through policy loans.

General Accounts

With a whole life policy, the insured does not control the investment vehicle. Policies are invested in the insurance company’s general account through the purchase of long-term bonds and mortgages. As a result, during a period of decreasing interest rates, whole life products can be expected to produce superior results since rates can be locked in when interest rates in general are higher. In contrast, rates in an increasing environment are locked in to their portfolios until maturity. There is no flexibility within a whole life policy. Premium payments, type of investment vehicle, and change in death benefit are all fixed. The safety of cash value is high, but the potential rate of return is low to moderate. If interest rates are rising, the price of the policy is declining, and you may want to suggest replacing the policy. (See Planning Issue 10.)

If the premiums paid to the insurance company turn out to be more than the company needs because expenses are lower than expected, the company’s portfolio investment return will be larger than the company expected. As a result, the company will then return some of the excess premium to the policyholder as a dividend or excess interest. Life insurance dividends are not taxable as income because they represent an excess of premium.

Premium Payments

The premium consists of mortality charge, policy expense, and a cash value. When the insured reaches 100 years of age, the policy endows with the face amount of the policy collectible by the insured. Since mortality tables end at age 100, the insurer considers the client dead and pays the face amount of the policy.

Whole life policies are packaged in a variety of ways. One policy, a limited-pay whole life policy, is a whole life policy with a death benefit continuing through age 100. The only difference between this and the traditional whole life policy is that premiums are paid only for a specified period, for example, seven years. In other words, the policyholder prepays the policy. A policy is considered to be fully paid up when the cash value of the basic contract plus the value of the dividend additions or deposits equals the net single premium for the policy in question at the insured’s attained age. The premium-paying period influences the cash value buildup in the policy. This is accomplished by using part of the investment return or dividends from long-term bonds and mortgages to pay the mortality and the expense charges on the policy for the rest of the policyholder’s life.

Advantages and DisAdvantages

Advantages of a whole life policy include lifetime coverage for the insured, a forced savings element, loan privileges, and a variety of premium payment plans. Over time, the cost is lower than term, the rate of return if the policy is kept until death is quite reasonable, and the policy will do a better job than universal life in keeping up with inflation. Disadvantages include a higher cost of death protection, a low rate of return, lack of flexibility, and incompatibility with inflation.

Assessment

Whole life policies are most appropriate for people who want or need a forced savings arrangement and for people who want lifetime coverage. As interest rates increased during the late 1970s, the returns received from insurance companies on long-term bonds and mortgage portfolios of whole life portfolios declined. As a result, in order to prevent policyholders from borrowing their cash reserves and investing these funds in other financial products, the insurance industry offered the following incentives:

• Existing policyholders were given the option to have their policies upgraded to reflect current market rates. Policies were upgraded through higher interest rates on cash values and higher future dividends and rates on policy loans.

• New types of policies were introduced—such as universal life, which tied cash value to short-term money market rates.

• Variable life insurance and universal variable life insurance were introduced, which segregated policy assets into a separate account.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

DICTIONARIES: http://www.springerpub.com/Search/marcinko

PHYSICIANS: www.MedicalBusinessAdvisors.com

PRACTICES: www.BusinessofMedicalPractice.com

HOSPITALS: http://www.crcpress.com/product/isbn/9781466558731

CLINICS: http://www.crcpress.com/product/isbn/9781439879900

BLOG: www.MedicalExecutivePost.com

FINANCE: Financial Planning for Physicians and Advisors

INSURANCE: Risk Management and Insurance Strategies for Physicians and Advisors

Filed under: Experts Invited, Insurance Matters, Risk Management | Tagged: cash value insurance, Jeffrey H. Rattiner, Whole life Insurance | 5 Comments »