Some Modern ROR versus RORR Musings

By Rick Kahler MS CFP®

By Rick Kahler MS CFP®

http://www.KahlerFinancial.com

Is there anything more important than the overall rate of return you earn on your investment portfolio?

Yes, there is. It’s the real rate of return.

Past Half Decade

Over the past five years, even diversified portfolios have earned relatively low returns. Many investors are fearful that this has significantly reduced the income they can expect to receive upon retirement.

To see whether that fear is justified, let’s look at some numbers. Based on a model portfolio I follow that holds nine different asset classes, the average return for the past three years (after all fees and expenses) was 2.45%. The five-year return was a little better at 2.67%. However, the seven-year return was 5.62%.

If an expected long-term (10 years or more) overall return on the same portfolio was 5.00%, at first glance it appears the portfolio slightly exceeded its expectation for seven years, but fell considerably short the last three and five years.

Now – Take a Second Glance

But, if there is a first glance, you know there is a second glance coming. And that second glance highlights a seemingly obscure fact that changes the picture considerably. In every future return expectation, there is also another estimate that rarely is mentioned, but which is as important as the rate of return. This is the rate of inflation.

While the long-term expected overall return was 5.00%, the long-term expected rate of inflation was 3.00%. That means there was an expectation the investments would earn 2.00% above the rate of inflation.

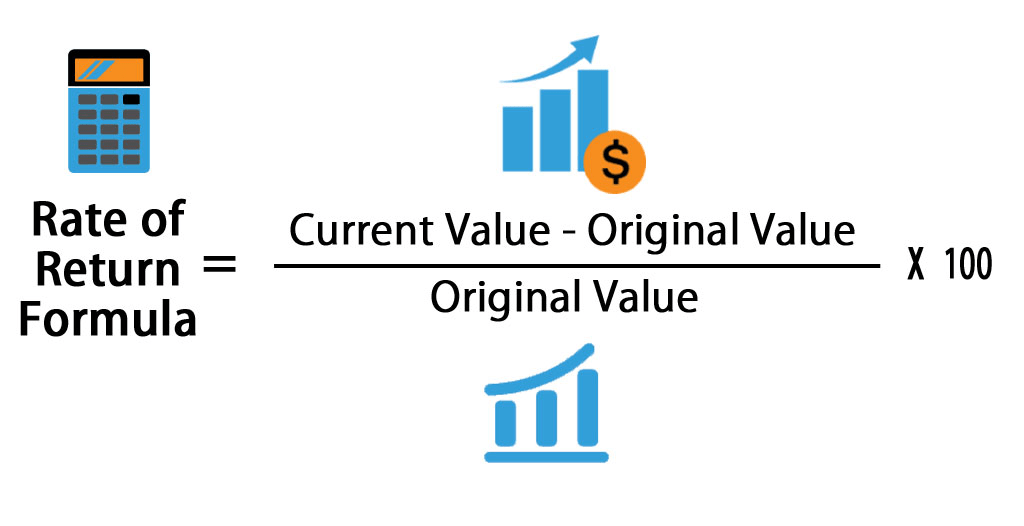

This is known as the real rate of return (RROR) and it’s far more important than the overall rate of return.

For example, if the projected inflation rate was 4%, the expected real rate of return would have been 1%. At a projected inflation rate of 6%, the real rate of return would have actually been negative.

Most financial planners base their projections of a client’s retirement income on the real rate of return. A real rate of return of 2% is very common.

The Real Rate of Return

Taking into account the real rate of return, what has actually happened over the past three, five, and seven years? Overall expected returns have definitely been lower over the past three and five years. So has the rate of inflation. While the estimated inflation rate was 3.00%, the actual inflation rate was significantly lower, at 0.78% for the past three years and 1.03% for the past five. Subtracting these numbers from the overall rate of return (2.45% for three years and 2.67 for five years) gives us the real rates of return: 1.68% and 1.64% for the last three and five years. Compared with the estimated real return of 2.00%, this is slightly lower but still close to hitting the target.

***

***

Looking at the seven-year real rate of return, things go from “ok” to “phenomenal.” While the overall rate of return of 5.62% was higher than the expected return of 5.00%, the inflation rate was 1.03% instead of the expected 3.00%. This resulted in a real rate of return of 4.59%, more than double the expected real rate of return.

Bottom Line

The bottom line is that those investors who have been in the market for seven years will have more to spend in retirement than previously projected. In investment circles, this is called a home run.

For physician investors discouraged by recent overall return numbers, a second look might give you cause to cheer up. If you’ve invested in a diversified portfolio, rebalanced, and stayed the course during market crashes, things may be better than they seem.

Assessment

Thanks to one of the lowest inflation rates in modern history, you could be further ahead than you thought.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

8

8

***

Filed under: Investing, Portfolio Management | Tagged: rate of return, real rate of return, rick kahler | 1 Comment »