By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Understanding Stock Market Options: A Strategic Investment Tool

Stock market options are financial instruments that offer investors a versatile way to participate in the equity markets. Unlike traditional stock trading, options provide the right—but not the obligation—to buy or sell an underlying asset at a predetermined price within a specified time frame. This flexibility makes options a powerful tool for hedging, speculation, and income generation.

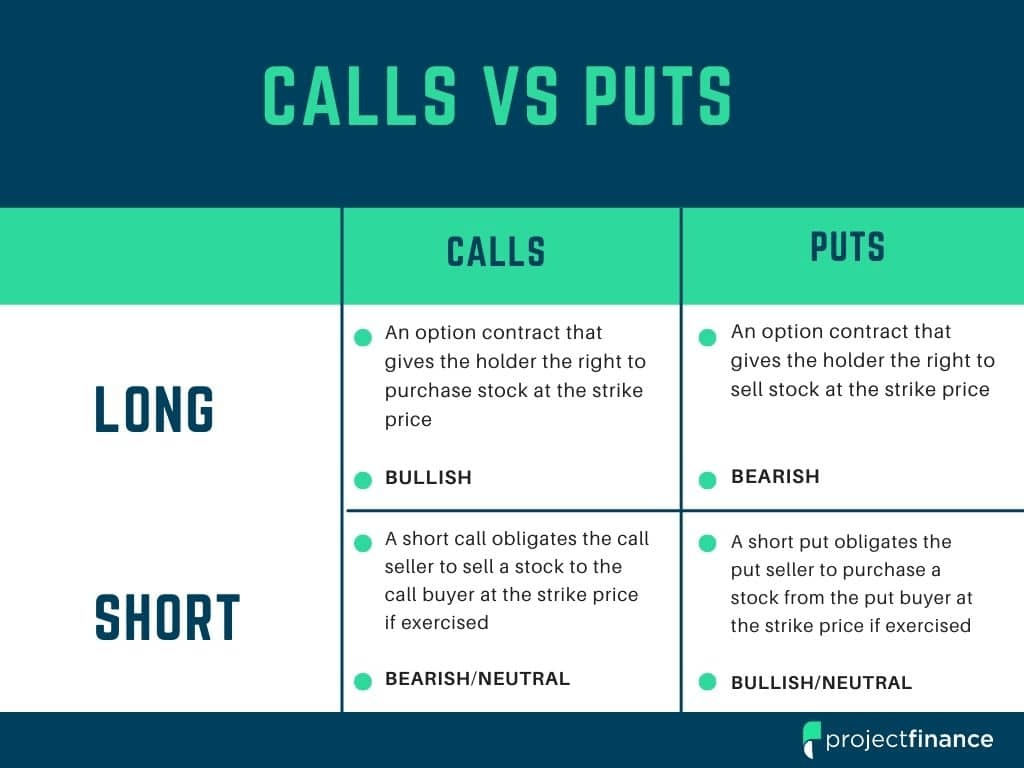

There are two primary types of options: calls and puts. A call option gives the holder the right to buy a stock at a specific price, known as the strike price, before the option expires. Investors typically purchase call options when they anticipate a rise in the stock’s price. Conversely, a put option grants the right to sell a stock at the strike price, and is used when an investor expects the stock to decline. Each option contract typically represents 100 shares of the underlying stock.

Options are traded on regulated exchanges such as the Chicago Board Options Exchange (CBOE), and their prices are influenced by several factors. These include the underlying stock’s price, the strike price, time until expiration, volatility, and prevailing interest rates. The premium, or cost of the option, reflects these variables and represents the maximum loss for the buyer.

***

***

One of the most compelling uses of options is hedging. Investors can use options to protect their portfolios against adverse price movements. For example, owning put options on a stock can offset potential losses if the stock’s value drops. This strategy is akin to purchasing insurance and is especially valuable during periods of market uncertainty.

Options also enable speculative strategies with limited capital. Traders can leverage options to bet on price movements without owning the underlying asset. While this can lead to significant gains, it also carries substantial risk, particularly if the market moves against the position. Therefore, understanding the mechanics and risks of options is crucial before engaging in such trades.

Another popular strategy involves writing options, or selling them to collect premiums. Covered call writing, for instance, involves holding a stock and selling call options against it. This generates income but caps potential upside if the stock surges beyond the strike price. Similarly, cash-secured puts allow investors to earn premiums while potentially acquiring stocks at a discount.

Despite their advantages, options are not suitable for all investors. Their complexity and potential for rapid loss require a solid grasp of financial concepts and disciplined risk management. Regulatory bodies and brokerages often require investors to pass suitability assessments before granting access to options trading.

In conclusion, stock market options are dynamic instruments that offer a range of strategic possibilities. Whether used for hedging, speculation, or income, they provide flexibility that traditional stock trading cannot match. However, their effective use demands education, experience, and a clear understanding of market behavior. For informed investors, options can be a valuable addition to a diversified financial toolkit.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Glossary Terms, Investing, Portfolio Management | Tagged: calls, finance, index options, Investing, options, put and callas, puts, stock calls, stock market, stock options, stock puts, trading | Leave a comment »