The Primary versus Secondary Stock Markets

By Dr. David E. Marcinko MBA

http://www.CertifiedMedicalPlanner.org

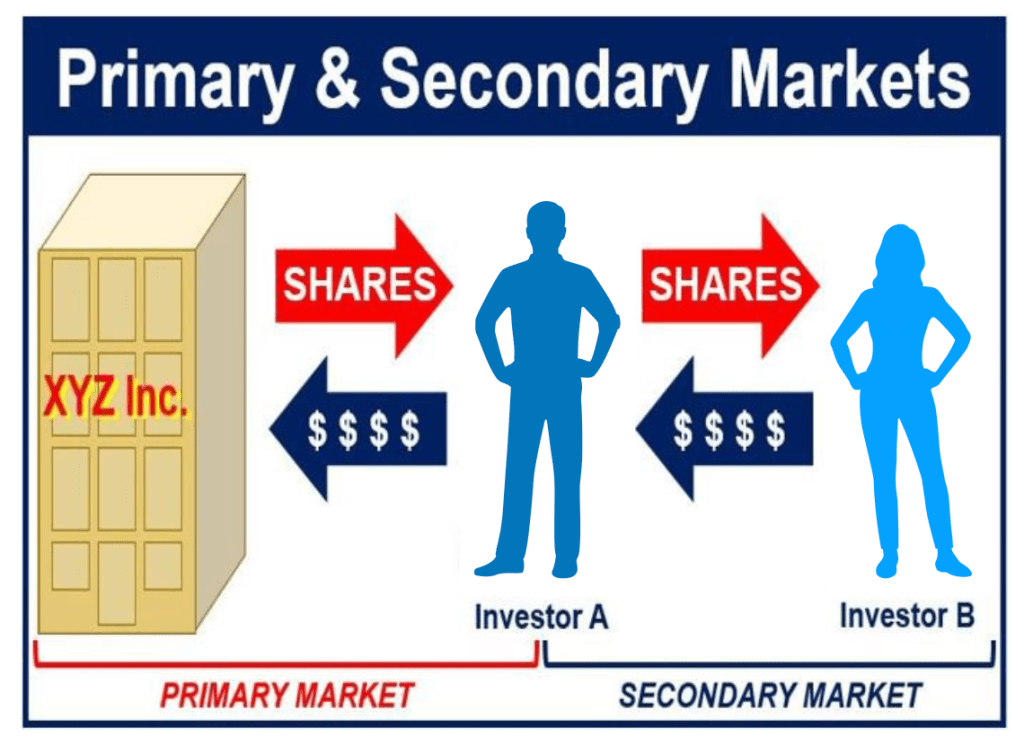

The purchase of common stock in an IPO (initial public offering) is facilitated through the use of members an investment bank underwriting syndicate or selling group. This is known as the primary market and the proceeds of sale go directly to the issuing company.

Six months later however, if a doctor wants to sell his shares, this would be accomplished in the secondary market. The term secondary market refers to trading in outstanding issues as the proceeds do not go to the issuer, but to the current owner of the securities, such as the physician investor.

Therefore, the secondary market provides liquidity to doctors who acquired securities in the primary market. After a doctor has acquired securities in the primary market, he wants to be able to sell the securities at some point in the future in order to acquire other securities, buy a house, or go on a vacation. Such a sale takes place in the secondary market. The medical investor’s ability to convert the asset (securities) into cash is heavily dependent upon the secondary market.

***

***

Assessment

All investors would be hesitant to acquire new securities if they felt they would not subsequently have the ability to sell the securities quickly at a fair price in the secondary market.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

8

8

***

Filed under: CMP Program, iMBA, Inc. | Tagged: primary market, secondary market | Leave a comment »