DEFINITIONS

By Staff Reporters

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Phantom equity is an increasingly popular tool within businesses, particularly startups and private companies, for incentivizing employees without diluting ownership. It allows firms to reward key personnel by linking compensation to the company’s performance, aligning employee interests with those of shareholders.

Basic Mechanisms of Phantom Equity

Phantom equity operates as a contractual agreement offering employees a simulated stake in the business without issuing actual stock. This arrangement appeals to companies aiming to maintain control over their equity structure while providing performance-based incentives. The benefits mimic stock ownership, such as dividends and capital appreciation, without the complexities of transferring actual shares.

The company establishes a phantom equity plan that defines terms such as vesting schedules, performance metrics, and payout conditions. Vesting schedules, often ranging from three to five years, encourage employee retention. Performance metrics may include revenue growth, profit margins, or other financial indicators aligned with strategic goals. Once vested, employees receive cash payments based on the value of the phantom shares, determined by the company’s valuation at payout.

Valuations, often conducted through third-party appraisals or internal financial metrics, directly affect payouts. If the company grows significantly, the value of phantom shares increases, resulting in higher payouts. Conversely, if performance declines, the value of these shares decreases, reducing compensation.

Types of Phantom Equity Plans

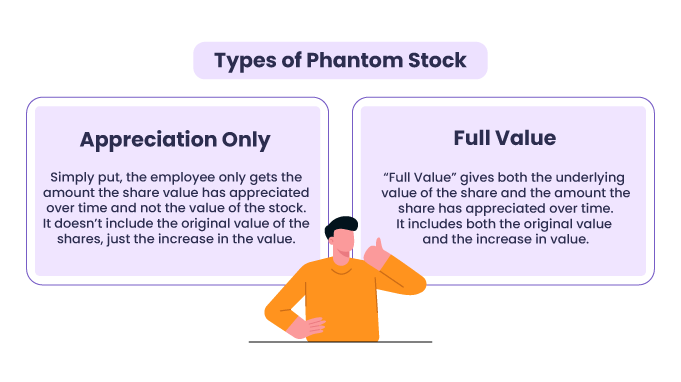

Phantom equity plans can be customized to suit a company’s goals, with two primary types being most common: appreciation-only arrangements and full-value arrangements.

Appreciation-Only Arrangements

Appreciation-only arrangements reward employees for the increase in the company’s value over a specified period. Employees are granted phantom shares that reflect the appreciation in the company’s valuation from the grant date to the payout date.

For instance, if phantom shares are initially valued at $10 each and the valuation rises to $15, the employee receives a payout of $5 per share. This structure ties employee rewards to company growth without affecting equity. Companies must rely on precise valuation methods, often adhering to GAAP or IFRS, to ensure fairness and compliance.

Full-Value Arrangements

Full-value arrangements provide payouts equivalent to the full value of phantom shares at vesting or payout. This includes both the initial value and any appreciation.

For example, if phantom shares are initially valued at $10 and later rise to $15, the employee receives $15 per share. While offering greater potential rewards, full-value arrangements require a larger financial commitment from the company. Careful financial planning and adherence to standards like ASC 718, which governs share-based compensation, are essential for managing these plans effectively.

Tax Implications: https://eqvista.com/phantom-stock/phantom-stock-plans-taxation/

COMMENTS APPRECIATED

Like and Review

***

***

Filed under: "Advisors Only", Career Development, CMP Program, Glossary Terms, Investing, Taxation | Tagged: appreciation-only, canada, CMP, full-value, insurance, job, money, phantom equity, phantom stock, stock equity plans, tax, taxes | Leave a comment »