By Staff Reporters

***

***

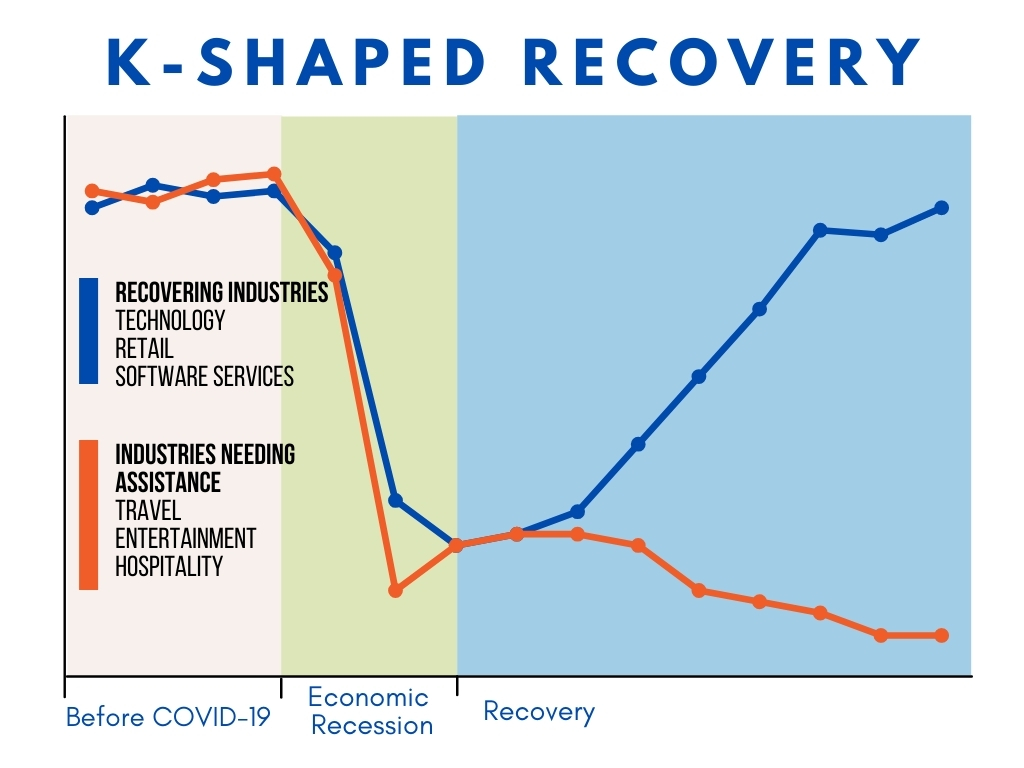

Understanding the K-shaped Economy

According to Olivia Voltaggio, in a V-shaped economy, things go down but then bounce back for everyone. In a K-shaped economy, the overall economy might go down. Only some parts of it recover, while others keep struggling.

In a K-shaped economy, people’s financial situations vary widely. Not everyone faces the same struggles. Lenders and financial institutions need to be flexible with strategy. They need to understand the different challenges their customers are dealing with.

Navigate with caution: The gaps in economic recovery highlight the importance of taking a careful, strategic approach.

How did we end up with a K-shaped recovery in 2024?

Inflation-driven price increases seem to be getting more stable. But, they may not reach the goal set by the government until 2026. This has made things more expensive for regular families.

For example, people with student loan debt had to start paying it back in October 2023. This was after a pandemic-induced grace period. Student loan repayment made budgeting harder. Borrowers might need to spend more on average than expected. For young adults (Gen Z), it could be even more.

Finally, more people are using credit cards because things are getting more expensive. Some are struggling to pay their credit card bills on time.

COMMENTS APPRECIATED

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing | Tagged: credit cards, economics, economy, finance, inflation, interest rates, K, K economy, K shaped economy, Olivia Voltaggio, V economy | Leave a comment »