By Staff Reporters

***

***

‘Customized portfolio and tax management for a broader spectrum of investors’

The Charles Schwab Corporation (SCHW) announced, on March 31, 2022, the upcoming launch of a new service, Schwab Personalized Indexing. Schwab touts this as a new solution that brings the power of customized portfolio and tax management to a broader spectrum of investors.

Rick Wurster, president of The Charles Schwab Corporation, stated in a press release: “Direct indexing has long been available to ultra-high net worth investors and institutions able to meet very high investment minimums. But now, thanks to technology innovations and industry developments like Schwab’s introduction of online commission-free trading, we’re able to lower the barriers to direct indexing for more investors and the advisors who serve them.” Schwab expects the new service, which is trademarked, to be available by the end of April 2022.

Key Takeaways

- Charles Schwab (SCHW) is introducing Schwab Personalized Indexing, a direct indexing service for accounts as small as $100,000.

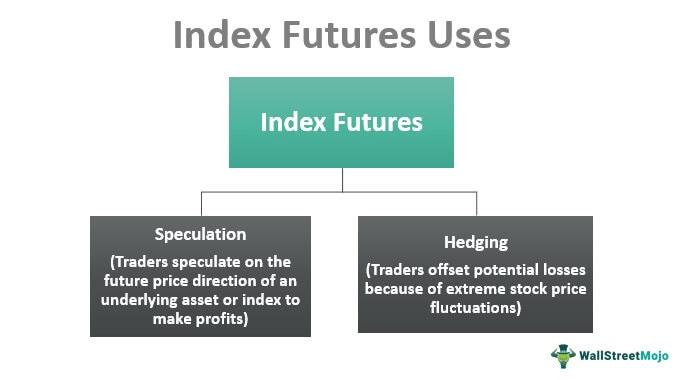

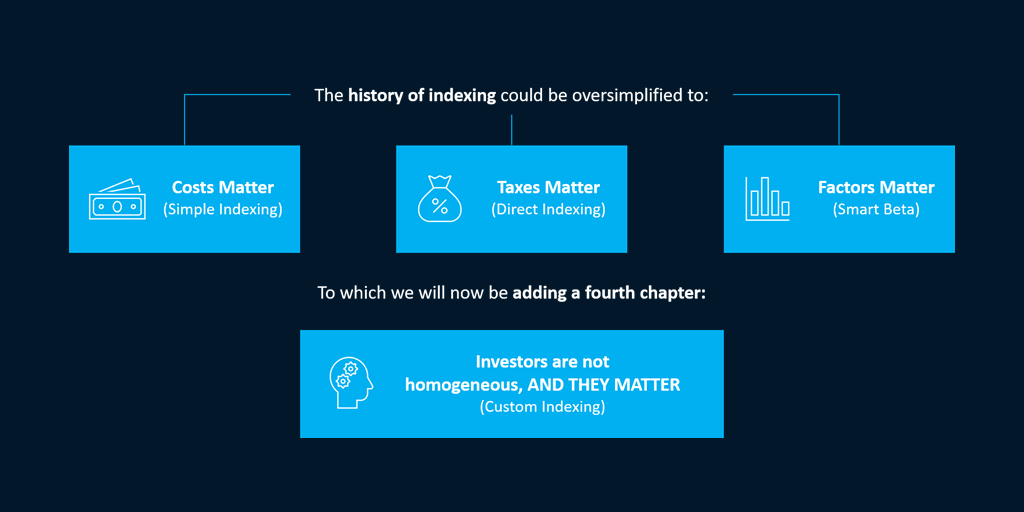

- Direct indexing involves holding the individual securities in an index, allowing for greater tax management.

- The service is expected to be available by the end of April 2022, and Schwab expects to add options and features over the next 12-18 months.

Key Features

Unlike an index fund, direct indexing involves direct ownership of the underlying securities in an index. Thus, it may offer a greater level of tax management for the investor. Within separately managed accounts, Schwab Personalized Indexing is based on a proprietary optimization process that includes daily monitoring of client portfolios and tax-loss harvesting technology. Each client account is to be optimized based on its current holdings and the potential capital gains taxes due on unrealized gains.

Available Strategies

Investors initially can choose among three index-based strategies that can be customized. These are a U.S. large cap strategy based on the Schwab 1000 Index, a U.S. small cap strategy based on the S&P SmallCap 600 Index, and an environmental, social, and governance (ESG) strategy based on the MSCI KLD 400 Social Index. Each strategy seeks index-like returns with enhanced after-tax benefits. Schwab expects to add more strategies and features during the next 12-18 months.

Account Minimums and Fees

Schwab Personalized Indexing initially will require an account minimum of $100,000. Schwab notes that most direct indexing offerings currently on the market start at $250,000 or higher.1

Fees start at 0.40% of assets. Schwab indicates that this is less expensive than many direct indexing programs currently available to advisors and investors.

CITE: https://pressroom.aboutschwab.com/press-releases/press-release/2022/Schwab-Introduces-Schwab-Personalized-Indexing/default.aspx

***

COMMENTS APPRECIATED

Thank You

***

ORDER: https://www.routledge.com/Comprehensive-Financial-Planning-Strategies-for-Doctors-and-Advisors-Best/Marcinko-Hetico/p/book/9781482240283

****

Filed under: "Ask-an-Advisor", Alternative Investments, Breaking News, Experts Invited, Investing | Tagged: index, index fund, Personalized Indexing, Schwab, SCHWAB: Introduces Personalized Indexing | Leave a comment »