On the “Buy low and Sell high” Strategy

By Rick Kahler CFP® http://www.KahlerFinancial.com

“Buy low and sell high.” That was my simple approach when I was a smart young investment advisor. I poured over a company’s balance sheet, earnings statements, and forecasted returns. Then I bought those companies that were bargains and waited for my gains to roll in. More times than not, they did—eventually.

“Buy low and sell high.” That was my simple approach when I was a smart young investment advisor. I poured over a company’s balance sheet, earnings statements, and forecasted returns. Then I bought those companies that were bargains and waited for my gains to roll in. More times than not, they did—eventually.

The problem came with the “not” and “eventually.” A majority of my picks did go up in value, but the minority that were “nots” still lost enough to have a negative impact on my bottom line. Even more frustrating, some of my “nots” turned into gains “eventually” after I sold them.

My investment returns were similar to findings from Dalbar, Inc., a financial services research firm. Dalbar’s studies have shown that average active investors barely beat inflation over the long term. They significantly underperform investors who put their money in an index fund of stocks and leave it alone.

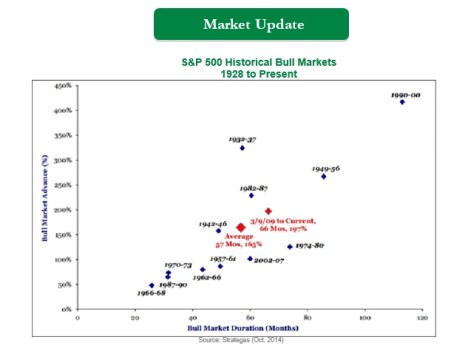

So much for my early investment brilliance! Over the past 40 years, I’ve learned that with every passing year I know less than I thought I did the year before. I’ve proven to myself I have no idea where any market is going tomorrow, next month, next year, or in the next 10 years.

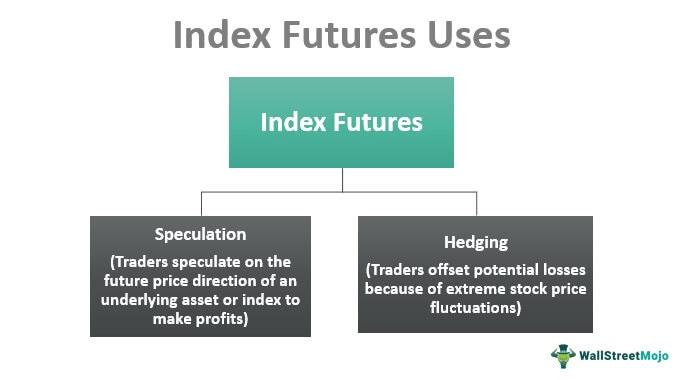

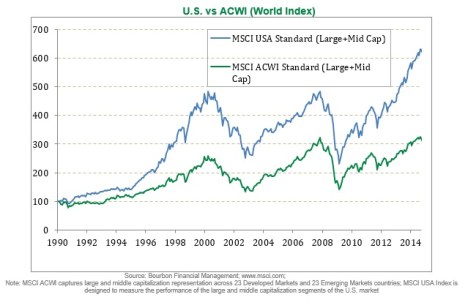

This awareness has led me to become increasingly passive in my investments. In passive investing, rather than trying to time the buying and selling of winners and losers, you instead buy a representative sample of the entire market. This is possible in any market: bonds, stocks, real estate investment trusts, or commodities. You simply buy mutual funds and exchange-traded funds (ETF’s) called index funds.

Benefits

The two biggest benefits of passive investing are cost and diversification.

Costs

Index funds have incredibly low costs, with annual fees as low as 0.1%. Contrast that with the average equity fund that costs 1.5%, fifteen times more. According to research, 97% of active mutual fund managers don’t beat the index over 20 years. Even the 3% who do must beat the index by more than the 1.5% fee they charge, in order for their investors to come out ahead.

Diversification

The smaller number of stocks owned – the more my fortunes are tied to those few companies. It’s the old adage, “don’t put all your eggs in one basket.” By owning index funds, I own hundreds or thousands of securities. While I will never hit a home run, I also will never strike out. My returns will be “average.” Investing may be one of the few professions where being average puts you in the 97th percentile of all investment managers.

The NaySayers

Not all of my peers agree with this philosophy. Many very smart investment advisors jumped off the passive investing bandwagon after 2008 and returned to tactical asset allocation, which is another name for timing the markets.

###

###

Harold’ Strategy

A noted investment advisor, Harold Evensky MBA CFP® of Evensky & Katz, addressed this issue at a conference last year. After the 2008 crisis, his firm hired researchers to evaluate whether they could find any tactical strategies that would have avoided the crisis. They found some that, in hindsight, would have worked. Yet he didn’t feel those strategies could be comfortably applied looking forward. Instead, the firm decided to add a 20% allocation to non-correlated alternative investments, something I’ve done since the late 90’s. In other words, they increased their clients’ diversification.

Assessment

The bottom line is that passive investing actually gives you more control. It allows you to focus on reducing costs and taxes, the aspects of investing you can control. It frees you from trying to beat the market and worrying over what you can’t control.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Hospitals: http://www.crcpress.com/product/isbn/9781439879900

Physician Advisors: www.CertifiedMedicalPlanner.org

Filed under: Investing, Portfolio Management | Tagged: active investing, Dalbar, diversified porfolios, ETFs, Evensky & Katz, exchange-traded funds, Inc., Mutual Funds, passive investing, Rick Kahler CFP® | 1 Comment »