A Concept All Financial Advisors, Planners and Insurance Sales Agents Should Know

SPONSOR: http://www.CertifiedMedicalPlanner.org

By Staff Reporters

***

***S

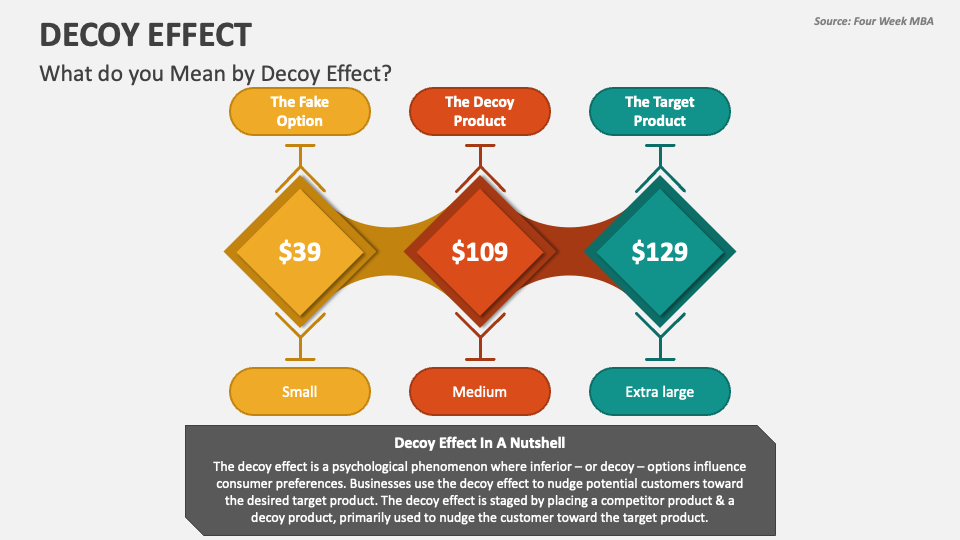

Decoy Bias Effect is a dubious phenomenon in decision-making where the introduction of a third, less attractive option (the “decoy”) influences individuals to change their preference between two other options.

The decoy bias effect describes how, when we are choosing between two alternatives, the addition of a third, less attractive option (the decoy) can influence our perception of the original two choices. Decoys are “asymmetrically dominated:” they are completely inferior to one option (the target) but only partially inferior to the other (the competitor). For this reason, the decoy effect is sometimes called the “asymmetric dominance effect.”

EXAMPLE: This bias is commonly used in financial planning sales; as well as marketing and mutual fund, ETF, REIT, stock broker, insurance agent and financial advisor pricing strategies to manipulate investor choices.

COMMENTS APPRECIATED

Refer and Like

***

***

Filed under: Ask a Doctor, CMP Program, Experts Invited, Glossary Terms, Insurance Matters, Investing, mental health | Tagged: asymmetric dominance effect, choice, choice manipulation, CMP, competitor, decoy bias, decoy effect, Influencers, insurance agents, manipulation, marketing, mental health, psychology, sales, Target | Leave a comment »