By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

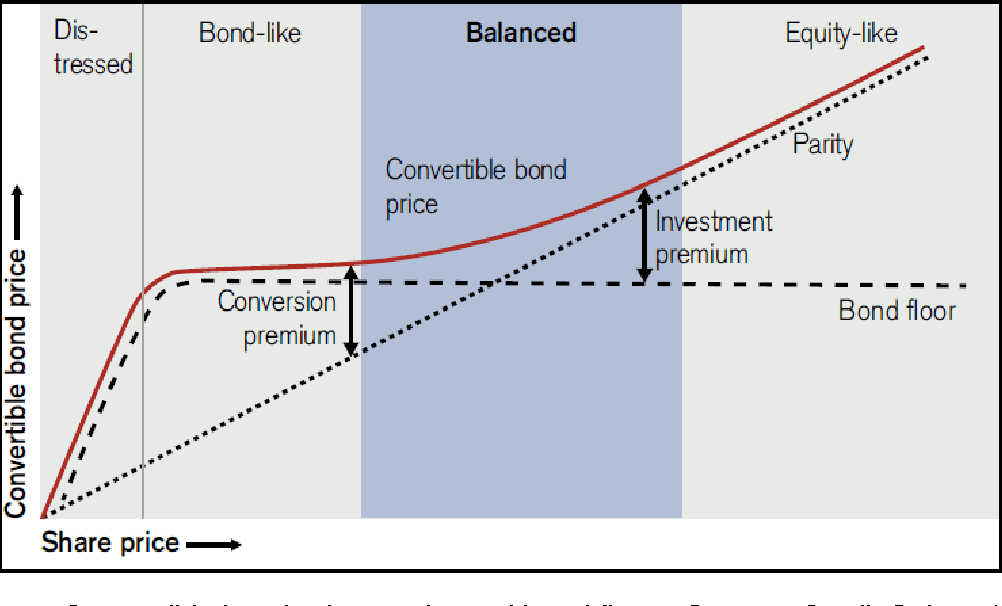

Convertible securities are those that can be converted at the investor’s choice into other investments, normally into shares of the issuer’s underlying common stock. Convertibles are typically issued as bonds or preferred stock.

Convertible bonds, which provide an ongoing stream of income, can be converted into a preset number of shares of the company’s common stock and have a maturity date. Unlike common stock, which pays a variable dividend depending on a corporation’s earnings, convertible preferred stock pays a fixed quarterly dividend. It can be converted into common stock at any time, but often are perpetual.

Corporate securities (corporate bonds and notes) are debt instruments issued by corporations, as distinct from those issued by governments, government agencies, or municipalities.

Corporate securities typically have the following features: 1) they are taxable, 2) they tend to have more credit (default) risk than government or municipal securities, so they tend to have higher yields than comparable-maturity securities in those sectors; and 3) they are traded on major exchanges, with prices published in newspapers.

CITE: https://www.r2library.com/Resource/Title/0826102549

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Financial Advisor Listings, Financial Planning, Funding Basics, Glossary Terms, iMBA, Inc., Investing, Marcinko Associates | Tagged: convertible bonds, convertible securities, convertible stock, corporate securities, finance, iMBA, Investing, investment, Marcinko, personal-finance, stocks | Leave a comment »