CHARTER COMMUNICATIONS: Why we’re confident in our investment

December 12, 2022

When my wife Rachel and I were getting married, the preparations for the wedding were stressful. It was the usual stuff – finding caterers, picking a wedding dress and invitations, shrinking the enormous guest list, and making a lot of other (in hindsight), unimportant decisions. (My advice to my kids: Have a destination wedding in Hawaii on the beach; this will shrink your guest list by 90%, leaving only those who really care about you. This way, you’ll be planning a small party, not orchestrating a giant brawl.)

I remember the preparations for the wedding being unnecessarily frustrating. My bride and I thought once we got married and the wedding was behind us, life would get easier. My father made an important observation: “Do you think all your problems will go away once you get married? This is when a different, often more difficult, chapter of your life begins – you’ll be facing different, more important, problems.”

He was so right.

This applies to investing as well. Researching companies is preparation for the wedding. But after we buy a stock – “get married” – is when the real research begins, because life happens to companies. I have to admit, this wedding analogy is imperfect on many levels: Selling stocks is not as traumatic as getting divorced (our stocks don’t know we own them). We are not really married to our stocks; we would love to own them for a long time but will sell them with ease if new information starts hinting that our initial thesis was wrong.

I did not enjoy the preparations for my wedding, but I actually love doing research. Most of our research doesn’t turn into weddings – we buy only a few companies a year but research hundreds.

If this analogy is so bad, why keep it? It highlights what investing is and, as importantly, what it is not. Plus, I sank an hour into it, which I’ll never get back.

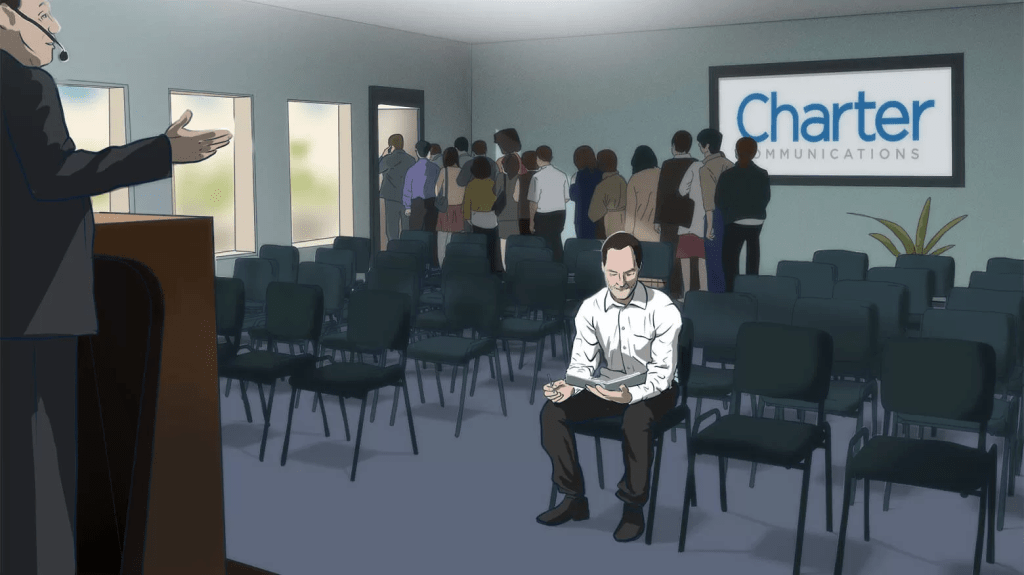

We had done a tremendous amount of research before we bought Charter Communications (CHTR). It seems like we have done twice as much research since we bought CHTR (“got married to it“) and have been kicked in the face by the declining stock price. However, we are convinced that our initial decision, although in hindsight it was imperfectly timed (an understatement), was the correct one.

The market’s concerns about the competitive threat to cable operators from fiber and fixed wireless drove all cable stocks down, creating an opportunity (more on that later). The more work we have done, the more we are convinced that this threat, though it may shave off a few percent from revenue growth in the short run, will have little impact on cable operators’ cash flows in the long term.

This is what I wrote about wireless competition: Let’s start with 5G. It is exponentially better than 4G. It is faster, has less latency, and drains batteries less. But it is still constrained by the scarcity of wireless spectrum – the “air pipe.” This is why wireless providers usually limit how much you can download on your device. Typical wireless providers put a cap of 50GB a month of downloads per household. The average cable customer consumes 400GB of data if they have TV service and 700GB if they don’t. (Remember, if you don’t have TV, you stream it over the internet, and thus consume more data.) Our internet data consumption is only moving in one direction, at a very fast pace, indefinitely: up! This will put further stress on the finite 5G spectrum, whereas broadband’s upward bound is virtually unlimited.

5G wireless customers will pay as much as Charter cable customers but will get 10-15x less data and slower speeds. If each 5G customer used as much internet as broadband customers, wireless providers would either go broke (they’d have to be spending hundreds of billions of dollars on new spectrum) or download speeds would slow to a crawl.The observation above is partially correct. T-Mobile, after merging with Sprint, has more spectrum than AT&T and Verizon and has been offering unlimited broadband, at very fast download speeds, for only $30 a month.

Brendan Snow (IMA analyst) and I went to the T-Mobile store to check it out. T-Mobile offered broadband in Brendan’s neighborhood but not in mine. I live in a very average suburban neighborhood, but despite owning more spectrum than its rivals, T-Mobile doesn’t have enough spectrum capacity to offer its service to me. Remember, broadband users consume 50–70 times more broadband than traditional wireless consumers.

Also, this offer is only available to customers who have wireless service with T-Mobile. I have read reviews of T-Mobile’s broadband service, and they all mention one thing in common: Service is intermittent and speed fluctuates a lot depending on the time of day. Bottom line: This service will take some market share from cable providers in areas with low population density, where cable companies have limited presence anyway.

Fiber is another threat that drove cable stocks down. “Fiber to the home providers” offer 1 gigabit speed on both downloads and uploads. Both Charter and Comcast have announced they will be upgrading their networks to DOCSIS 4.0, a new technology which, at a relatively small cost (less than $200 per customer), will put cable data speeds at parity with fiber. Comcast announced that they will roll out the technology everywhere by 2025, while Charter said they will focus on markets where they face the most competition from fiber. DOCSIS 4.0 will turn cable networks from smart to “brilliant” (this is how one cable executive described this technology), promising to increase uptime and reduce maintenance capital expenditures.

Our thinking on the wireless offerings by Charter and Comcast has changed. Initially, we thought it was a defensive move to compete with wireless providers, with the ultimate goal of bundling it with internet service and reducing churn. We assumed it would produce a limited stream of cash flows.

We changed our thinking here.

Cable companies have a structural cost advantage in offering wireless service, as consumers have been trained to connect their phones to Wi-Fi. This means that when we are on our mobile phones, we offload 90–95% of our data to wired networks, where cable companies have virtually unlimited capacity.

Wireless companies have to spend a tremendous amount of money on building and maintaining wireless networks, and pay tens of billions of dollars for spectrum. Cable companies, however, are able to shortcut this expense by buying buckets of data from wireless companies (AT&T and Verizon). As a result, both Charter and Comcast are offering wireless service at a significant discount to their wireless competitors.

The wireless business is growing at a rate of 30–40% a year, requiring minimal investment from cable companies. In a few years, once it reaches scale, it will become a significant contributor to earnings.

December 18th, 2022

Just as we were ready to send out this letter, right after I wrote the above, Charter held an investor day on December 13th. Management said they would roll out DOCSIS 4.0 across their full footprint in three years. The cost per customer is going to be $100, not the $200 that we, and everyone else, had expected. This was great news! $100 is less than two months of internet subscription.

Charter has 55 million customers, so additional investment (capital expenditure) over the next three years will total $5.5 billion. Charter will pay for it from its abundant cash flows. This new technology will allow customers to download and upload at 1 gigabit per second (with potential to take it up to 10 gigabits per second), putting cable technology completely on par with fiber.

In addition to increasing the company’s competitive advantage and pricing power (its product is priced lower than the fiber competition), management said that this investment in DOCSIS 4.0 will reduce its maintenance capital expenditures by $600 million to $1 billion a year.

The stock declined by 20% in response to the news. We laughed!

The market did not appreciate this investment, as it meant that Charter would have to reduce the amount of money it spends on buying back its own stock by the increase in capital expenditures. This is one of the best examples of time arbitrage we have ever seen. The market is not looking past its nose. Charter’s management’s time horizon is years into the future, as it should be.

The value of any asset, be it a company, cow, or bond, is the present value of its future cash flows. We put the new assumptions into our Charter discounted cash flow model: We reduced its cash flows by $5.5 billion over the next three years, and then increased them by $800 million after that (a midpoint number in the company’s guidance). Cost savings alone, ignoring the improved ability to raise prices and grow market share, increase Charter’s value (the present value of cash flows) by about 10%.

Paraphrasing Ben Graham, in the short term the market is a speculative casino but in the long term it is an Excel spreadsheet running discounted cash flows.

All cable stocks have declined, so we did some minor reshuffling of the portfolio. In taxable accounts we sold all of Charter, took a short-term loss, and bought Comcast. In nontaxable accounts we reduced our position in Charter and bought Comcast. We also bought Liberty Broadband in almost all accounts. Liberty Broadband is a company controlled by John Malone that owns about 30% of Charter. The Liberty discount for Charter has widened to about 25%, giving us the opportunity to buy Charter at a significant discount. Though this number may vary by portfolio, our exposure to the cable industry is now about 5%.

Charter and Comcast are like two first cousins who share the same grandparent – John Malone. A large part of Comcast is TCI, a company started by Malone. Today, Malone personally owns roughly 2% of Charter through his Liberty Broadband holding.

Cable is a much better business than wireless, for one reason: It has much less competition. Charter and Comcast compete with wireless carriers and phone companies, but they don’t compete against each other. Their footprints don’t overlap and will never overlap. In fact, they have joint ventures together. Charter’s and Comcast’s cable businesses are of a similar size. Charter has a laser focus on the cable business, whereas Comcast also has a media business (it owns NBC, Sky, and other media properties). Charter is more leveraged than Comcast, but its stock is cheaper. We like the management of both companies. |

What’s down

What’s down